Loading

Get Pa Pa-40 C 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PA PA-40 C online

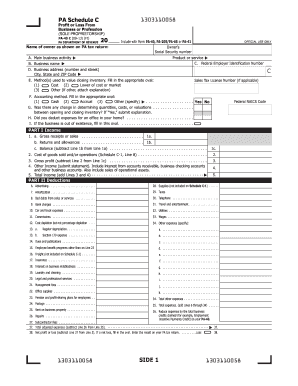

The PA PA-40 C is an essential form for individuals reporting income or loss from a business as a sole proprietor in Pennsylvania. This guide provides a clear, step-by-step approach to filling out the form online, ensuring a smooth and accurate submission process.

Follow the steps to fill out the PA PA-40 C online.

- Click ‘Get Form’ button to access the PA PA-40 C online.

- Fill in the identification information accurately, including the owner's name as it appears on the PA tax return, Social Security number, and business details.

- Provide the main business activity description and enter the business name as registered with the IRS.

- Enter the Federal Employer Identification Number if applicable, along with any Sales Tax License number.

- Complete the business address section with the full address and fill in the appropriate ovals for closing inventory valuation and accounting method.

- Answer any applicable questions regarding inventory changes and office deductions.

- Proceed to Part I: Income by reporting gross receipts, returns and allowances, and calculating the balance.

- Continue with Part II: Deductions by itemizing expenses such as advertising, travel, and utilities.

- Check that all calculations are correct, ensuring total adjusted expenses and net profit or loss are reported accurately.

- Once complete, save your changes, download, or print the form for your records.

Complete your PA PA-40 C online today to streamline your filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To qualify for the Pennsylvania tax forgiveness credit, your income must fall below specific thresholds established by the state. Factors such as your filing status and family size will influence your eligibility. This credit can significantly reduce your PA state tax burden. It's wise to use tools like those offered on USLegalForms to navigate this process.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.