Loading

Get Or Dor 150-101-159 2017-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR DoR 150-101-159 online

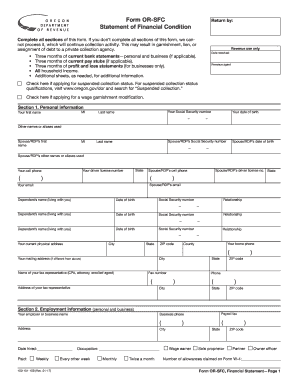

Filling out the OR DoR 150-101-159 form online can be a straightforward process when you follow the right steps. This guide provides clear instructions on how to complete each section of the form accurately and efficiently.

Follow the steps to fill out the OR DoR 150-101-159 form effectively.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin with Section 1, Personal Information. Fill in your full name, Social Security number, date of birth, and any aliases. Include your contact information and that of your spouse or domestic partner if applicable.

- Proceed to Section 2, Employment Information. Provide details regarding your employment status, including employer name, address, and occupation. Be sure to note your payment frequency and the number of allowances claimed on Form W-4.

- In Section 3, General Financial Information, list all bank accounts, vehicles, personal property, and other financial assets. Attach supporting documents as required, such as recent bank statements and loan details.

- Fill out Section 4, Assets and Liability Analysis, where you will summarize your total assets and liabilities based on the information provided in Section 3.

- Complete Section 5, Monthly Income and Expense Analysis. List all sources of income and actual expenses incurred each month, ensuring accuracy to reflect your financial situation.

- In Section 6, provide any additional information that may be pertinent to your financial condition. Include your proposed monthly payment and proposed payment date if relevant.

- Finalize the form by signing Section 7, Authorization to Disclose. Both you and your spouse or domestic partner must sign if applying jointly. Ensure all signatures are dated.

- Once the form is complete, review all entries for accuracy. Save the changes, and if needed, download, print, or share the form as appropriate.

Start filling out the OR DoR 150-101-159 form online today to ensure your financial condition is accurately represented.

Yes, you can file your Oregon state taxes online. Many taxpayers prefer this method for its convenience and speed. You can utilize the OR DoR 150-101-159 form through online platforms like uslegalforms to simplify your filing process and ensure comprehension of state tax laws.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.