Loading

Get Co Claim For Refund

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CO Claim For Refund online

Filling out the CO Claim For Refund is a necessary step for users seeking to reclaim funds that may have been overpaid or erroneously submitted. This guide provides clear and supportive instructions for completing the form online, ensuring that everyone can navigate the process efficiently.

Follow the steps to fill out the CO Claim For Refund form online.

- Click 'Get Form' button to access the CO Claim For Refund and launch it for completion.

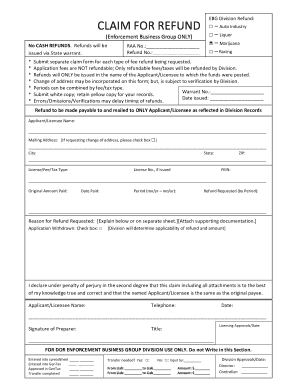

- Begin by selecting the appropriate refund type. Choose from Auto Industry, Liquor, Marijuana, or Racing, as applicable to your claim.

- Fill in the RAA Number and Refund Number fields as required. These numbers help identify your claim within the appropriate division.

- Enter your name as the applicant/licensee and provide your mailing address. If you’d like to change your address, check the appropriate box.

- Indicate the specific License/Fee/Tax Type you are requesting a refund for, along with the License Number and Federal Employer Identification Number (FEIN), if applicable.

- Provide details of the original amount paid and the date that payment was made. You will also need to specify the period for which the refund is being requested.

- Clearly state the reason for the refund request. You may need to explain further on a separate sheet or attach supporting documentation.

- If you are requesting a refund due to application withdrawal, please check the specified box. The division will then assess the refund's applicability.

- A declaration statement must be signed, confirming that all information provided is accurate and truthful. Ensure you include your name and contact number.

- Finally, after completing the form, save your changes. You can then download, print, or share your CO Claim For Refund as needed.

Start completing your documents online today and ensure your claims are submitted efficiently.

Related links form

A CDOR spokesperson said taxpayers who have yet to receive their TABOR refund should call 303-951-4996 to see the status of their check.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.