Loading

Get Oh Dte 1 2002

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH DTE 1 online

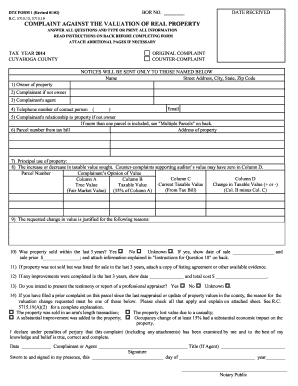

The OH DTE 1 is a complaint form used for disputing the valuation of real property in Cuyahoga County. This guide provides clear, step-by-step instructions to help users navigate the online process of completing the form efficiently.

Follow the steps to fill out the OH DTE 1 online.

- Click the ‘Get Form’ button to obtain the OH DTE 1 form and open it in your preferred document management tool.

- Begin by indicating whether the form is an original complaint or a counter-complaint. This should be noted at the top of the form.

- Fill in the tax year you are disputing; make sure this corresponds to the current year you wish to address, in this case, 2014.

- Provide your name and complete address in the designated fields. If you are not the property owner, include the name of the owner or the agent representing them.

- Enter the telephone number and email address of the contact person for this complaint, ensuring that all information is accurate for follow-up.

- Specify the parcel number from your tax bill along with the address of the property you are complaining about.

- Indicate the principal use of the property by selecting the appropriate description provided on the form.

- Input your opinion on the change in taxable value you seek, filling in the columns as required: current taxable value, change in value, and true value.

- Explain the reasons justifying the requested change in value in the designated area on the form, providing as much detail as necessary.

- If applicable, provide details regarding any sales of the property in the last three years, including the sale date and price. Attach any required documentation.

- If the property was listed for sale but not sold, attach any pertinent listing agreements or evidence.

- Document any improvements made to the property within the last three years, including dates and costs associated with these improvements.

- Indicate whether you plan to present the testimony or report of a professional appraiser by marking the appropriate box.

- If a prior complaint has been filed on this parcel, select the applicable reasons for the requested valuation change, and provide explanations as needed.

- Sign and date the form, ensuring that you declare the information is true and correct. Have the form notarized if necessary before submission.

- Once all sections are completed, save your changes, download, print, or share the completed form as needed.

Start filling out the OH DTE 1 online today to ensure your property valuation dispute is properly addressed.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Disputing property taxes in Cuyahoga County can be a multi-step process. First, gather evidence supporting your claim of overvaluation. You will then need to file a formal complaint with the Board of Revision. The OH DTE 1 process can be a critical tool in this endeavor, helping you navigate the appeal effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.