Loading

Get Ca Ftb 100s 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 100S online

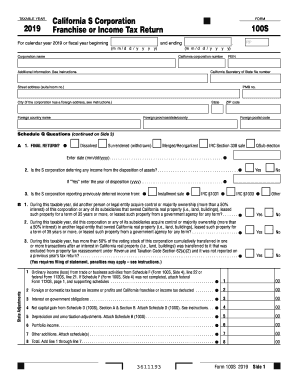

Filling out the CA FTB 100S form online can be a straightforward process if you have a clear understanding of its components. This guide will provide you with step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to fill out the CA FTB 100S form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter the corporation name as registered with the California Secretary of State. Make sure to input any additional identifying information such as the California corporation number and FEIN, if applicable.

- Provide the corporation's street address, including suite or room number. If the corporation has a foreign address, ensure you fill in the foreign country name and postal code.

- Respond to Schedule Q questions by selecting appropriate options. For instance, indicate if this is the final return by checking 'Yes' or 'No' and enter the appropriate dates as required.

- Continue answering Schedule Q questions about ownership and control of the corporation, ensuring that all fields relevant to your situation are accurately filled.

- Fill in the income section, detailing ordinary income from business activities as instructed. If you completed Schedule F, ensure the figures match or attach necessary schedules.

- List any applicable deductions, ensuring that you reference and attach necessary schedules as outlined for various deductions such as charitable contributions or taxes.

- Complete the tax calculation sections by inputting relevant figures and determining the total amount due or overpayment, based on your entries and deductions.

- Review all entries for accuracy and ensure that required signatures from authorized officers are included.

- Once all fields are complete, save your changes, and finalize your document by downloading, printing, or sharing the completed form.

Complete your CA FTB 100S form online today to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Estimated tax is a method used to pay tax on income when your withholding and credits do not cover your tax liability. ... Use the Ohio SD 100ES vouchers to make estimated Ohio school district tax payments. Joint filers should determine their combined estimated Ohio tax liability and make joint estimated payments.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.