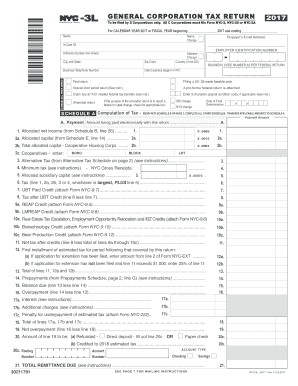

Get Nyc Dof Nyc-3l 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NYC DoF NYC-3L online

How to fill out and sign NYC DoF NYC-3L online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Nowadays, a majority of Americans choose to handle their own tax returns and additionally, to finalize reports digitally. The US Legal Forms online platform streamlines the process of preparing the NYC DoF NYC-3L efficiently and conveniently. It now takes no more than thirty minutes, and you can complete it from any place.

The most efficient method to submit NYC DoF NYC-3L swiftly and effortlessly:

Ensure that you have accurately completed and submitted the NYC DoF NYC-3L within the designated time. Consider any deadlines. Providing inaccurate information with your fiscal documents could lead to severe penalties and complications with your annual tax return. Utilize only professional templates from US Legal Forms!

- Access the PDF form in the editor.

- Look at the highlighted fillable fields. This is where you should input your information.

- Select your choice when you encounter the checkboxes.

- Move to the Text icon and other advanced options to manually tailor the NYC DoF NYC-3L.

- Review all information thoroughly before you continue signing.

- Create your personalized eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Authenticate your document online and record the date.

- Click Done to proceed.

- Download or send the file to the intended recipient.

How to revise Get NYC DoF NYC-3L 2017: tailor forms online

Wave farewell to a conventional paper-based method of processing Get NYC DoF NYC-3L 2017. Have the document finished and verified in moments with our premium online editor.

Are you required to alter and complete Get NYC DoF NYC-3L 2017? With a professional editor like ours, you can accomplish this task in mere minutes without the need to print and scan documents repeatedly.

We offer fully modifiable and user-friendly document templates that will serve as a foundation and assist you in finishing the necessary form online.

All forms automatically incorporate fillable fields you can complete as soon as you access the form. However, if you wish to enhance the current content of the form or introduce new elements, you can select from a range of customization and annotation features. Emphasize, censor, and comment on the text; add checkmarks, lines, text boxes, graphics, notes, and remarks. Moreover, you can quickly validate the form with a legally-binding signature. The finalized form can be shared with others, archived, sent to outside applications, or converted into any widely-used format.

Don't waste time completing your Get NYC DoF NYC-3L 2017 the outdated way - with pen and paper. Utilize our feature-rich tool instead. It offers you a versatile array of editing capabilities, built-in eSignature features, and user-friendliness. What sets it apart from similar alternatives is the team collaboration functionality - you can collaborate on documents with anyone, establish a well-organized document approval process from start to finish, and much more. Try our online tool and get the best value for your money!

- Simple to set up and use, even for those who haven’t filled out paperwork online before.

- Powerful enough to meet multiple modification requirements and document types.

- Safe and secure, ensuring your editing process is protected every time.

- Accessible across various operating systems, making it easy to complete the document from anywhere.

- Able to create forms based on ready-made templates.

- Compatible with numerous document formats: PDF, DOC, DOCX, PPT, and JPEG, etc.

Get form

Related links form

If you are a partnership operating in New York, you are required to file a NY partnership return. This includes reporting the partnership's income and expenses to ensure tax compliance. By adhering to this requirement, you contribute to the tax responsibilities outlined by the NYC DoF and help maintain transparency in your business activities.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.