Get In Eic Worksheets 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN EIC Worksheets online

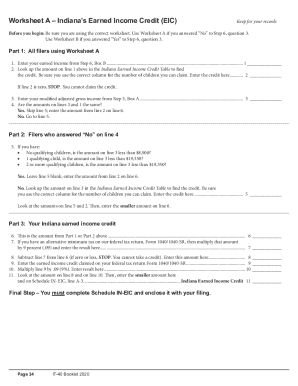

Filling out the Indiana Earned Income Credit (EIC) Worksheets online can seem challenging, but this guide will walk you through each step of the process. Designed to be user-friendly, these worksheets help determine your eligibility for tax credits. Whether you are filing for the first time or need a refresher, follow this guide to ensure your information is accurately submitted.

Follow the steps to complete the IN EIC Worksheets online.

- Press the ‘Get Form’ button to obtain the IN EIC Worksheets, which will allow you to access the form for completion in the designated editor.

- In Part 1, enter your earned income from Step 6, Box B. This amount is critical as it determines your eligibility for the EIC.

- Next, refer to the Indiana Earned Income Credit Table using the amount from line 1 to identify your potential credit. Ensure to select the correct column based on the number of qualifying children.

- Continue by entering your modified adjusted gross income from Step 5, Box A on line 3.

- Answer the question regarding the amounts on lines 1 and 3. If they are the same, skip to line 6 using the amount from line 2. If different, proceed to line 5.

- If you answered 'No' on line 4, assess your situation based on the number of qualifying children and compare it with the thresholds for earning levels specified. Enter the appropriate values accordingly.

- In Part 3, take the credit amount calculated in either Part 1 or Part 2 and enter it on line 6.

- If applicable, calculate any alternative minimum tax from your federal return and multiply it by 9 percent before entering the result on line 7.

- Complete the necessary calculations on lines 8 through 11, ensuring to enter the smallest value where required, particularly when comparing line 8 and line 10.

- For the final step, ensure to complete Schedule IN-EIC and enclose it with your filing when submitting your taxes.

Start filling out the IN EIC Worksheets online today to ensure you maximize your potential tax credits.

2019 Refund Delays There are two key exceptions to the estimated 21-day return timeline. Due to the Protecting Americans from Tax Hikes (PATH) Act of 2015, the IRS must hold tax refunds that include the Earned Income Tax Credit (EITC) and the Additional Child Tax Credit (ACTC) until February 15, 2019.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.