Loading

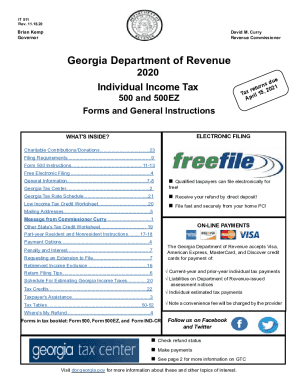

Get Ga It 511 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA IT 511 online

The GA IT 511 is an essential form for individuals filing their income tax in Georgia. This guide provides step-by-step instructions on how to accurately complete this form online, ensuring a smooth filing experience.

Follow the steps to successfully fill out the GA IT 511 online.

- Press the 'Get Form' button to download and open the form in your preferred editor.

- Enter your personal information, including your name, address, and Social Security number. Make sure to provide accurate details.

- Indicate your residency status by checking the appropriate box. The options are full-year resident, part-year resident, or nonresident.

- Select your filing status from the options provided. This includes single, married filing jointly, married filing separately, or head of household.

- Enter the number of exemptions you're claiming, including yourself, your spouse, and any dependents.

- Provide your Federal adjusted gross income from your Federal tax return. Ensure this figure is correct as it impacts your tax calculation.

- If applicable, make any necessary adjustments using Schedule 1. This could include additions or subtractions to your income based on Georgia law.

- Calculate your Georgia adjusted gross income by adding or subtracting the adjustments to your Federal adjusted gross income.

- Choose either the standard deduction or itemized deductions, entering the appropriate figures based on your selection.

- Compute your Georgia taxable income, which is your adjusted gross income minus either your standard or itemized deductions.

- Apply the Georgia tax table to determine your tax liability based on your taxable income.

- Enter any available credits, including the low income credit and other applicable state tax credits.

- Subtract your total credits from your tax liability to find your final amount due or overpayment.

- Review the completed form for accuracy, ensuring all required pages and documents are attached.

- Save your changes, and you may download, print, or share the completed form as needed.

Complete your GA IT 511 online for a quick and easy filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Does Georgia require state 1099 tax filing? Yes, Georgia requires you to file 1099s to the Georgia State Revenue Commissioner.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.