Get Mt Dor Ab-26 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

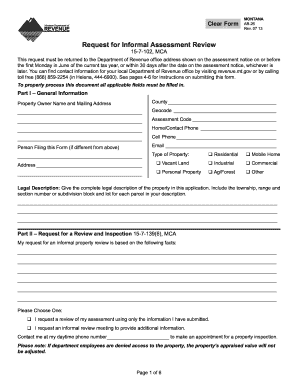

Tips on how to fill out, edit and sign MT DoR AB-26 online

How to fill out and sign MT DoR AB-26 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, the majority of Americans opt to handle their own tax submissions and, additionally, to complete documents in digital format.

The US Legal Forms online platform facilitates the process of e-filing the MT DoR AB-26, making it simple and convenient.

Ensure you have accurately completed and submitted the MT DoR AB-26 on time. Keep an eye on any deadlines. Providing incorrect information on your financial documents can result in significant penalties and complications with your annual tax return. Utilize only reliable templates from US Legal Forms!

- Access the PDF sample in the editor.

- Notice the marked fillable areas. This is where you can input your details.

- Choose the option to select when you encounter the checkboxes.

- Visit the Text icon and other advanced features to manually modify the MT DoR AB-26.

- Review all the information before proceeding to sign.

- Create your unique eSignature using a keyboard, camera, touchpad, mouse, or smartphone.

- Verify your document online and indicate the date.

- Click Done to proceed.

- Download or send the document to the intended recipient.

How to modify Get MT DoR AB-26 2013: personalize forms online

Your swiftly editable and adaptable Get MT DoR AB-26 2013 template is easily accessible. Capitalize on our repository with a built-in online editor.

Do you delay finishing Get MT DoR AB-26 2013 because you simply don't know how to begin and how to proceed? We recognize your concerns and have an excellent tool for you that has nothing to do with overcoming your postponement!

Our web-based catalog of ready-to-utilize templates enables you to search and choose from thousands of fillable forms designed for numerous use cases and scenarios. However, obtaining the form is just the beginning. We provide you with all the essential tools to complete, certify, and modify the document of your choice without leaving our website.

All you need to do is to access the document in the editor. Verify the wording of Get MT DoR AB-26 2013 and confirm whether it meets your requirements. Start adjusting the template by utilizing the annotation tools to give your form a more organized and polished appearance.

In conclusion, alongside Get MT DoR AB-26 2013, you'll receive:

With our comprehensive option, your completed forms are generally legally binding and fully encrypted. We promise to safeguard your most sensitive information.

Get everything you need to create a professionally-looking Get MT DoR AB-26 2013. Make the right choice and try our platform now!

- Insert checkmarks, circles, arrows, and lines.

- Highlight, black out, and amend the existing text.

- If the document is meant for others as well, you can add fillable fields and share them for other parties to complete.

- Once you're done modifying the template, you can download the file in any available format or choose any sharing or delivery options.

- A powerful suite of editing and annotation tools.

- A built-in legally-binding eSignature solution.

- The option to create forms from scratch or based on the pre-drafted template.

- Compatibility with various platforms and devices for enhanced convenience.

- Numerous options for protecting your documents.

- A variety of delivery options for easier sharing and dispatching documents.

- Compliance with eSignature laws governing the use of eSignature in online transactions.

Get form

Related links form

The Montana property tax relief for seniors form is designed to assist eligible seniors in reducing their property tax burden. This form is part of the MT DoR AB-26 initiative, which provides options to help seniors secure their financial well-being. Ensure you meet the eligibility requirements before applying to maximize your benefits.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.