Loading

Get Uk Hmrc Sa370 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UK HMRC SA370 online

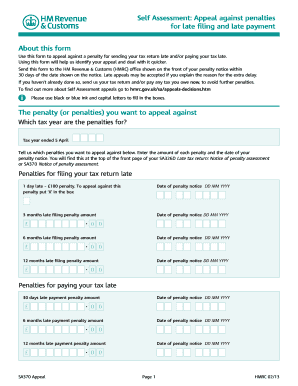

This guide provides step-by-step instructions to assist you in completing the UK HMRC SA370 form for appealing against penalties related to late filing and late payment. Filling out this form accurately will help ensure your appeal is processed efficiently.

Follow the steps to fill out the SA370 form online:

- Click ‘Get Form’ button to access the SA370 form and open it for completion.

- In the section labeled 'The penalty (or penalties) you want to appeal against', specify the tax year for which you are appealing. Enter the year that ended on 5 April.

- List the penalties you are appealing against by entering the amount and the date of each penalty notice. You will find this on the SA326D or SA370 Notice of penalty assessment.

- For penalties related to late filing, state whether you are appealing against the £100 penalty for being 1 day late, and mark an 'X' in the designated box. Additionally, record the dates and amounts for any penalties related to late filing after 3 months, 6 months, and 12 months as applicable.

- For penalties due to late payment, similarly record the relevant amounts and dates for the 3 months, 6 months, and 12 months late payment penalties.

- In the space provided for 'Your reason for making an appeal', provide a detailed explanation of the reasons for your appeal. Include any relevant dates and supporting evidence, and if necessary, attach additional sheets.

- Make sure to sign and date your appeal at the designated area. Provide your daytime phone number and additional contact information if it differs from the one previously entered.

- If you are signing on behalf of someone else, indicate your capacity (e.g., agent, executor) accordingly.

- Once all fields are completed, save your changes, download a copy for your records, and prepare to send the completed form to the HMRC office indicated on your penalty notice.

Begin your appeal process and ensure your documents are submitted online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Filing an appeal against a penalty order with UK HMRC SA370 involves submitting a written appeal that outlines your reasons for disputing the penalty. Be sure to include your taxpayer information and any relevant documents. Keeping thorough records can strengthen your case and help ensure your appeal is taken seriously.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.