Loading

Get Canada T3010 E 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Canada T3010 E online

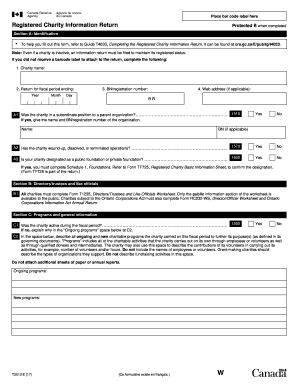

The Canada T3010 E form is essential for registered charities as it provides the Canada Revenue Agency with crucial information regarding their activities and finances. This guide offers step-by-step instructions to help you complete this form accurately and efficiently online.

Follow the steps to fill out the Canada T3010 E form online.

- Press the ‘Get Form’ button to access the T3010 E form and open it in your preferred editor.

- In Section A, fill in your charity's identification details, including the charity name, fiscal period end date, BN/registration number, and, if applicable, the web address.

- For question A1 regarding subordinate status, indicate 'Yes' or 'No' and provide the parent organization’s name and BN if applicable. Repeat this for questions A2 and A3 regarding the charity's operational status and designation.

- Move to Section B, where all charities must complete Form T1235, which pertains to directors, trustees, and like officials.

- In Section C, answer questions about the charity’s activity during the fiscal period, outlining ongoing and new programs in C2. Limit descriptions to the charity's charitable activities, excluding fundraising efforts.

- Continue with questions C3 to C6 to detail any gifts made to qualified donees and fundraising activities. Attach necessary schedules as indicated.

- Fill out Section D with your financial information, noting if the report was prepared on an accrual or cash basis, and complete the asset and liability statements.

- In Section E, ensure a person with authority signs the return, and complete all required contact information.

- Complete Section F by providing the physical and mailing addresses for the charity and identifying who completed the return.

- Review the checklist to confirm all necessary schedules and attachments are included before saving or submitting the completed form.

Ensure your charity remains compliant by completing the Canada T3010 E form online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

profit in Canada typically requires a minimum of three directors on its board. These members should not be related to ensure a diversity of perspectives and comply with the regulations. Having a wellstructured board enhances governance and decisionmaking. Engaging with the right people can significantly improve the efficacy of your organization.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.