Loading

Get Mt Cgr-2 2010-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT CGR-2 online

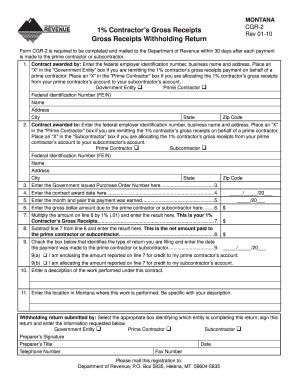

The MT CGR-2 form, also known as the Contractor’s Gross Receipts Withholding Return, is an essential document for contractors in Montana. This guide provides clear, step-by-step instructions for filling out the form online, ensuring a smooth and accurate completion process.

Follow the steps to complete the MT CGR-2 form online.

- Click the ‘Get Form’ button to obtain the form and launch it in your preferred editor.

- In the first section, titled 'Contract awarded by', enter the federal employer identification number, business name, and address. Indicate whether you are a Government Entity or Prime Contractor by placing an ‘X’ in the appropriate box.

- Next, move to the 'Contract awarded to' section. Provide the federal employer identification number, business name, and address for the contractor or subcontractor. Again, mark the appropriate box to specify if you are remitting for a Prime Contractor or allocating for a Subcontractor.

- Enter the Government Issued Purchase Order Number in the designated field.

- Input the contract award date in the format MM/DD/YYYY.

- Fill in the month and year when the payment was earned.

- State the gross dollar amount due to the prime contractor or subcontractor in the next field.

- Calculate 1% of the amount from the previous line and enter this result in the subsequent field.

- Subtract the calculated 1% from the gross amount and record the net payment amount.

- Check the relevant box that describes the type of return you are filing and enter the date the payment was made.

- Provide a description of the work performed under this contract.

- Clearly state the location in Montana where the work was executed.

- Select the relevant entity — Government Entity, Prime Contractor, or Subcontractor — that is submitting this withholding return, then sign and provide the required information.

- Finally, review your completed form for accuracy. After verification, proceed to save changes, download, print, or share the form as needed.

Complete your MT CGR-2 form online today for a seamless filing experience.

Related links form

Failing to file a state tax return can result in penalties, interest on unpaid taxes, and possible legal action from the state of Montana. It's crucial to meet your filing obligations to avoid complications down the line. Understanding the MT CGR-2 regulations will help you remain compliant and mitigate risks associated with non-filing.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.