Loading

Get Mo 1746r 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO 1746R online

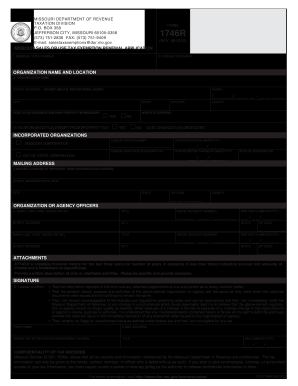

The MO 1746R is the Missouri Sales or Use Tax Exemption Renewal Application. This guide provides step-by-step instructions for completing the form online, ensuring a smooth process for users who may not have legal experience.

Follow the steps to complete the MO 1746R online successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your Missouri tax ID number in the designated field. If applicable, also provide your federal ID number to ensure proper identification.

- In the 'Organization Name and Location' section, input the full name of your organization, followed by the street address. Avoid using a P.O. Box or rural route.

- Fill in the contact information, including phone number, city, county, state, and zip code for the organization.

- Answer the questions regarding property ownership and property tax exemption status by selecting 'Yes' or 'No' as applicable.

- If applicable, provide your organization’s Missouri charter number and the date incorporated in the MM/DD/YYYY format.

- If the organization is an out-of-state corporation, indicate the state of incorporation and the respective registration date.

- If the mailing address differs from the organization address, enter it in the mailing address section, including any necessary details.

- In the 'Organization or Agency Officers' section, list the names, titles, social security numbers, and addresses of the officers. Ensure that birthday information is also provided in MM/DD/YYYY format.

- Attach a complete financial history for the last three years, including income sources, amounts, and a detailed breakdown of expenditures. Additionally, provide a description of civic or charitable activities with specific examples.

- Review and complete the signature section. Print your name, email address, and the title of the responsible person. Ensure you sign and date the form correctly.

- Once you have filled out all sections of the form, you can save changes, download a copy, print the form for your records, or share it as required.

Complete your MO 1746R form online today and ensure your organization's sales and use tax exemption remains active!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Applying for tax-exempt status in Missouri involves filling out the MO 1746R form and submitting it to the appropriate state tax authority. You’ll need to provide specific information regarding your organization or business type. The US Legal Forms platform can assist with templates and guidance to streamline your application process effectively.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.