Loading

Get Ga Dor It-app 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the GA DoR IT-APP online

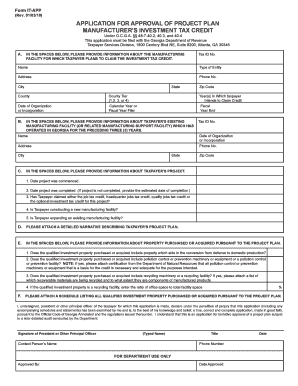

The GA DoR IT-APP is a critical form for taxpayers seeking to claim the investment tax credit for manufacturing facilities in Georgia. This guide will provide you with clear, step-by-step instructions to ensure you complete the form accurately and effectively.

Follow the steps to fill out the GA DoR IT-APP online.

- Use the ‘Get Form’ button to access the GA DoR IT-APP form and open it in your preferred editor.

- In section A, provide comprehensive details about your manufacturing facility, including the tax ID number, name, entity type, address, phone number, city, state, zip code, county, and county tier.

- Indicate the year(s) in which you intend to claim the credit, along with the date of organization or incorporation and whether you are a calendar year or fiscal year filer.

- Complete section B with information on your existing manufacturing facility, ensuring to include the tax ID number, name, date of organization or incorporation, address, phone number, city, state, and zip code.

- Move to section C and fill out the project information, detailing the commencement and completion dates of the project, and answer questions regarding previously claimed tax credits, constructing a new facility, or expanding an existing facility.

- In section D, attach a detailed narrative describing the project plan associated with your application.

- Proceed to section E to outline information on property purchased or acquired pursuant to the project plan, including specific questions regarding property aiding in conversion, pollution control, and recycling facilities.

- Complete section F by attaching a schedule listing all qualified investment properties purchased or acquired as part of the project plan.

- Finally, ensure the application is signed by the undersigned, who declares under penalties of perjury that the application is correct and complete to the best of their knowledge.

Start completing your GA DoR IT-APP online today to ensure you take advantage of the investment tax credit.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A letter from the Georgia Department of Revenue can stem from various reasons, such as confirming a tax filing, requesting additional documentation, or informing you of changes in your tax status. Always review the content thoroughly and respond as needed. If you're uncertain about the letter's implications, the GA DoR IT-APP can provide clarity and assistance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.