Loading

Get In Bc-100 2008

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN BC-100 online

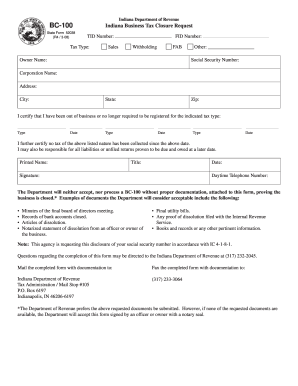

Filling out the Indiana Business Tax Closure Request, known as the IN BC-100, is a straightforward process. This guide will walk you through each section of the form to ensure that you can successfully submit your request online.

Follow the steps to complete the IN BC-100 form.

- Click the ‘Get Form’ button to access the IN BC-100 document.

- Enter your Tax Identification Number (TID Number) and choose the tax type from the options provided, including Sales, Withholding, and FAB. Ensure that the tax type selected reflects your business activities.

- Provide your business-related information by entering your Owner Name and Corporation Name. Fill in your business Address, City, State, and Zip code accurately to avoid any processing issues.

- In the certification section, indicate that you have ceased business operations or no longer need to be registered for the selected tax type. Be sure to include the types of taxes and the corresponding dates.

- Confirm that no taxes have been collected for the previously indicated tax types since the specified dates. This is necessary to release you from any further obligations.

- Sign and date the form, and provide your printed name, title, and daytime telephone number. These details are critical for verifying your identity and connection to the business.

- Gather the required documentation that proves your business is closed, such as minutes from the final board meeting, records of closed bank accounts, articles of dissolution, or a notarized statement. Attach these documents to the form.

- After reviewing the completed form and attached documents for accuracy, proceed to save your changes, download a copy, print it out, or share it as necessary.

Begin your request by completing the IN BC-100 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To close your Indiana sales tax account, you need to submit a request to the Indiana Department of Revenue. This usually requires a final return and payment of any outstanding tax liabilities. For assistance and to validate your forms, the USLegalForms platform is a great resource related to the IN BC-100, ensuring you meet all requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.