Loading

Get Or Or-40-v 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the OR OR-40-V online

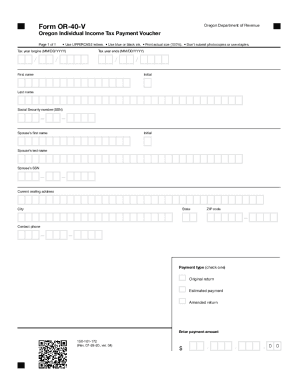

The OR OR-40-V is the Oregon individual income tax payment voucher form designed for individuals to submit their tax payments effectively. This guide provides clear instructions on how to fill out the form correctly and efficiently while filing online.

Follow the steps to complete the OR OR-40-V form online.

- Click the ‘Get Form’ button to access the OR OR-40-V form and open it in your preferred editing application.

- Fill in the tax year beginning and ending dates in the specified format (MM/DD/YYYY). Ensure the dates reflect the correct years for the payment period.

- Enter your full legal first name, middle initial (if applicable), and last name in the designated fields using UPPERCASE letters.

- Provide your Social Security number (SSN) in the appropriate section to ensure accurate processing of your tax payment.

- If applicable, enter your spouse’s first name, middle initial, last name, and Social Security number in the corresponding fields, also using UPPERCASE letters.

- Complete your current mailing address including the street address, city, state, and ZIP code to ensure any correspondence is directed correctly.

- Include your contact phone number to facilitate communication regarding your tax payment, if necessary.

- Select the appropriate payment type by checking one of the boxes: original return, estimated payment, or amended return.

- Input the payment amount in the designated field, ensuring to follow the provided format and including cents if applicable.

- After filling out all required fields, review the information for accuracy, then save changes, download, print, or share the completed form as necessary.

Complete your OR OR-40-V form online efficiently for accurate tax payment processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Individuals, including sole proprietors, partners, and S corporation shareholders, generally have to make estimated tax payments if they expect to owe tax of $1,000 or more when their return is filed.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.