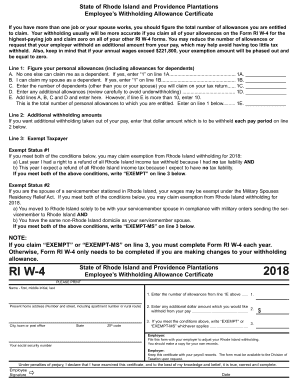

Get Ri Ri W-4 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign RI RI W-4 online

How to fill out and sign RI RI W-4 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Completing a tax form can turn into a major hurdle and a serious hassle if there is no adequate assistance provided. US Legal Forms has been established as an online solution for RI RI W-4 e-filing and offers numerous benefits for taxpayers.

Follow these instructions on how to complete the RI RI W-4:

Press the Done button on the top menu once you have completed it. Save, download, or export the finished form. Utilize US Legal Forms to ensure a secure and straightforward RI RI W-4 submission.

- Access the blank form on the website in the designated section or through the search engine.

- Click the orange button to open it and wait for it to load.

- Review the template and adhere to the instructions. If you haven't filled out the form before, follow the step-by-step directions.

- Focus on the highlighted fields. They are editable and need specific information to be entered. If you're unsure about what to input, refer to the instructions.

- Always sign the RI RI W-4. Use the built-in tool to create your e-signature.

- Click the date field to automatically insert the correct date.

- Re-examine the example to review and modify it before submission.

How to modify Get RI RI W-4 2018: tailor forms online

Place the appropriate document editing instruments at your disposal. Complete Get RI RI W-4 2018 with our reliable tool that integrates editing and eSignature capabilities.

If you wish to complete and verify Get RI RI W-4 2018 online effortlessly, then our web-based solution is your ideal choice. We offer a rich library of template-based forms that you can adapt and complete online. Furthermore, you do not need to print the form or rely on external tools to make it fillable. All essential features will be available for your use immediately upon accessing the document in the editor.

Let’s explore our web editing instruments and their main functionalities. The editor presents a user-friendly interface, so it won’t take much time to learn how to use it. We’ll review three primary components that enable you to:

- Alter and annotate the template

- The upper toolbar contains features that assist you in highlighting and obscuring text, sans graphics, and graphic elements (lines, arrows, and checkmarks, etc.), signing, initializing, dating the document, and more.

- Organize your paperwork

- Utilize the left toolbar if you wish to rearrange the document or delete pages.

- Make them shareable

- If you wish to enable the template for others to fill in and share it, you can employ the tools on the right and add various fillable fields, signature and date, text box, etc.

Get form

Related links form

To obtain a W-4 form, visit the IRS website or check with your employer, as most provide this form upon hiring. For state-specific forms like the RI RI W-4, you can easily download it from the Rhode Island Division of Taxation’s site. Platforms like USLegalForms also simplify this process by providing direct access to relevant tax forms.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.