Loading

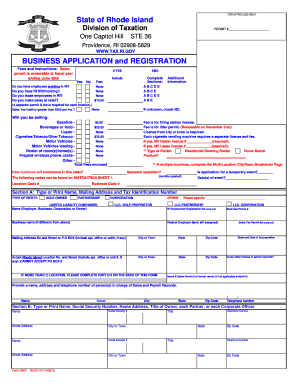

Get Ri Form Bar 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the RI Form BAR online

Filling out the RI Form BAR online can be a straightforward process when approached with careful attention to detail. This guide provides step-by-step instructions to ensure that you complete the form accurately and efficiently.

Follow the steps to complete the RI Form BAR online.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred online editor.

- Begin with Section A, where you should type or print your name, mailing address, and tax identification number. Make sure to select your type of entity from the provided options such as sole owner, partnership, corporation, etc.

- In Section B, provide the names, social security numbers, and addresses of owners, partners, or corporate officers. This information is essential for the proper identification of your business structure.

- Proceed to Section C, where you need to estimate the amount of Rhode Island withholding taxes you expect to withhold from employees each month. Also, indicate your filing status and number of employees.

- Section D requires a detailed description of your business activities. Clearly describe each significant activity or service you provide, including approximate sales percentages.

- If applicable, fill out Section D-2 to list establishments operating under your business if you have multiple locations.

- Finally, complete Section E with your certification and signature, confirming that the information provided is true and correct. Save your changes, and then download or print the completed form.

Complete your RI Form BAR online today for a streamlined application process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

In Rhode Island, LLCs are generally treated as pass-through entities for tax purposes, which means the income passes through to members and is reported on their individual tax returns. However, specifics can vary based on how the LLC elects to be taxed. It's advisable to consult the RI Form BAR for regulations and potential tax liabilities. Understanding your obligations can lead to more effective financial planning.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.