Loading

Get Oh It Re 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the OH IT RE online

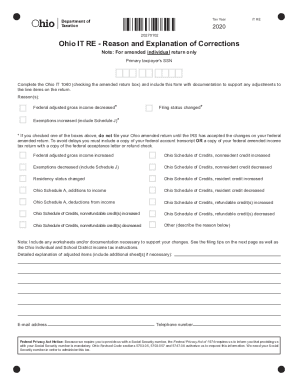

The Ohio IT RE form is essential for individuals who need to amend their tax return with the state of Ohio. This guide will help you navigate the process of filling out the form online, ensuring you provide all necessary information correctly.

Follow the steps to successfully complete the Ohio IT RE form.

- Press the ‘Get Form’ button to obtain the form and open it in your preferred digital editor.

- Enter the primary taxpayer's Social Security number in the designated field to identify the tax return being amended.

- Select the applicable reason for amending your return by checking the relevant boxes. Include more information in the detailed explanation section if necessary.

- Describe the details of the adjusted items in the space provided. If you need additional space, attach supplementary sheets as needed.

- Provide your email address and telephone number for potential follow-up or clarification regarding your amendment.

- Ensure you compile all necessary supporting documentation as instructed, including copies of your federal return if applicable.

- Review all entered information for accuracy and completeness before finalizing.

- Once you are satisfied with the information entered, save your changes, and choose to download, print, or share the completed form as needed.

Start filling out your Ohio IT RE form online today to ensure your amendments are processed efficiently.

In Ohio, sales tax exemption is available to churches, organizations exempt from federal taxation under IRC Sec. 501(c)(3), and nonprofit organizations operated for charitable purposes. ... Generally, purchases of items used in connection with an unrelated business activity are not exempt from sales tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.