Get Nc Certification Of 501(c)(3) Or Other Tax-exempt Status 2011-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC Certification of 501(c)(3) or Other Tax-Exempt Status online

Filling out the NC Certification of 501(c)(3) or Other Tax-Exempt Status online is an important step for organizations seeking to confirm their tax-exempt status. This guide provides clear, step-by-step instructions to help users navigate the form with ease.

Follow the steps to complete the certification form online.

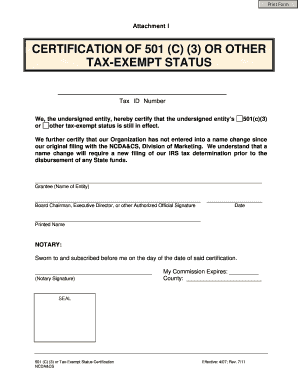

- Press the ‘Get Form’ button to access the NC Certification of 501(c)(3) or Other Tax-Exempt Status form and open it in your preferred online editor.

- Enter your organization’s Tax ID Number in the designated field. Ensure this number is accurate as it identifies your entity for tax purposes.

- In the section that states the certification of your 501(c)(3) status, confirm that the status is still in effect. This affirmation is essential for maintaining compliance with tax regulations.

- Certify that your organization has not undergone any name changes since the original filing with the North Carolina Department of Agriculture and Consumer Services (NCDA&CS). If you have changed your name, note that you must file a new IRS tax determination.

- Provide the name of the entity in the ‘Grantee’ section, ensuring it matches your organization's official name.

- Have the Board Chairman, Executive Director, or another authorized official sign the document in the designated signature field.

- Fill in the date of signature, which is required to validate the certification.

- Print the name of the person who signed the document, ensuring clarity in identification.

- If required, visit a notary public to have the certification officially acknowledged. The notary will need to sign and possibly place a seal on the form.

- Finally, review the completed form for accuracy, then save your changes. You may choose to download, print, or share the form as necessary.

Complete your documents online to ensure a smooth certification process.

Related links form

To obtain a 501(c)(3) certificate, follow a series of important steps. Begin with establishing your nonprofit corporation and drafting your bylaws. Next, complete IRS Form 1023 to formally request tax-exempt status. For a smoother experience, consider using the resources provided by USLegalForms, as they offer streamlined templates and expert guidance. This will assist you in successfully obtaining NC Certification of 501(c)(3) or Other Tax-Exempt Status.

Fill NC Certification of 501(c)(3) or Other Tax-Exempt Status

As of January 31, 2020, Form 1023 applications for recognition of exemption must be submitted electronically online at Pay.gov. A corporation which is exempt from taxation under Section 501(c)(3) of the Internal Revenue Code is called a "charitable or religious corporation" To be tax-exempt under section 501(c)(3) of the Internal Revenue Code, an organization must be organized and operated exclusively for exempt purposes. Under North Carolina law, organizations that meet the requirements of Section 501(c)(3) are also exempt from paying state corporate income tax. Apply for 501(c)(3) Status. If you are not eligible to file Form 1023-EZ, you must file Form 1023 to obtain recognition of exemption under Section 501(c)(3). The key to earning a sales tax exemption is being designated a charitable, tax-exempt 501(c)3 nonprofit organization under the Internal Revenue Code. Apply for 501(c)(3) Status. Our Department does not have anything to do with determining a charity's tax exempt status. All 501(c)(3) public charities.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.