Loading

Get Nc B-c-710 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NC B-C-710 online

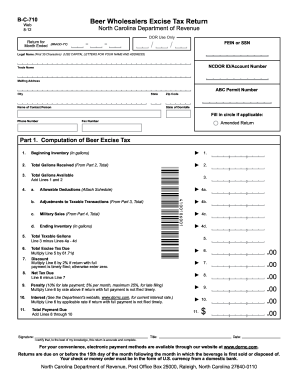

Filing the NC B-C-710 is an essential task for beer wholesalers in North Carolina. This guide offers a clear, step-by-step approach for completing the form online, ensuring compliance with state tax regulations.

Follow the steps to accurately complete the NC B-C-710 online.

- Press the ‘Get Form’ button to obtain the NC B-C-710 form and open it in your editor.

- Begin by entering the month for which you are filing, as well as your Federal Employer Identification Number (FEIN) or Social Security Number (SSN).

- In the 'Legal Name' section, provide your legal business name in capital letters, followed by your NCDOR ID or Account Number.

- Fill in your trade name and complete your mailing address, ensuring to include your city, state, and zip code.

- Indicate the name and contact information of a person who can be reached regarding this form, including their phone number and fax number.

- If applicable, check the box to indicate if this is an amended return.

- Proceed to Part 1, where you will compute the beer excise tax. Enter your beginning inventory in gallons, total gallons received, and calculate total gallons available.

- List allowable deductions in part 4a through 4d, including military sales and any adjustments to taxable transactions.

- Calculate the total taxable gallons and the total excise tax due based on your previous entries.

- Complete the sections for penalties and interest, if applicable, and calculate the total payment due.

- Sign and date the form, certifying its accuracy, before proceeding to submit it.

- Save changes, and choose to download, print, or share your completed form as required.

Complete your NC B-C-710 online today to ensure timely compliance with tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

In North Carolina, the excise tax on beer is imposed per gallon. This tax rate is set by state legislation and may change periodically. Understanding the specifics of NC B-C-710 ensures that you are aware of the current rates and compliance requirements for your business.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.