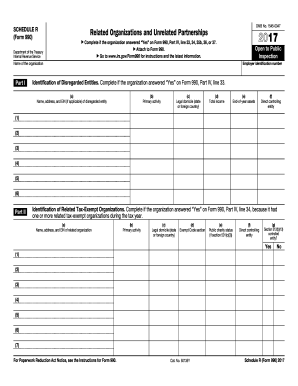

Get Irs 990 - Schedule R 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 990 - Schedule R online

How to fill out and sign IRS 990 - Schedule R online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When individuals aren’t linked with document management and legal protocols, submitting IRS paperwork can be incredibly challenging. We understand the importance of accurately completing documents. Our service provides the answer to simplify the process of submitting IRS forms as effortlessly as possible.

Follow these steps to efficiently and correctly submit IRS 990 - Schedule R online:

Using our comprehensive solution can certainly enable proficient completion of IRS 990 - Schedule R. Make everything conducive and simple for your work.

Click the button Get Form to access it and commence editing.

Complete all required fields in the document using our advanced PDF editor. Activate the Wizard Tool to make the process even easier.

Ensure the accuracy of the entered information.

Add the date of completion for IRS 990 - Schedule R. Utilize the Sign Tool to create your unique signature for document validation.

Conclude editing by clicking Done.

Send this document directly to the IRS using the method most convenient for you: via email, with virtual fax, or postal service.

You can print it on paper if a physical copy is required and download or save it to your chosen cloud storage.

How to modify Get IRS 990 - Schedule R 2017: tailor forms online

Utilize the ease of use of the multifunctional online editor while filling out your Get IRS 990 - Schedule R 2017. Take advantage of the variety of tools to swiftly fill in the gaps and provide the necessary information immediately.

Creating documents can be time-consuming and costly unless you have pre-prepared fillable forms to complete digitally. The most straightforward approach to handle the Get IRS 990 - Schedule R 2017 is to leverage our expert and feature-rich online editing options. We offer you all the essential tools for rapid document completion and enable you to modify your forms, tailoring them to any requirements. Additionally, you can leave remarks on the revisions and add notes for others involved.

Here’s what you can accomplish with your Get IRS 990 - Schedule R 2017 in our editor:

Distribute the documents in multiple ways and save them on your device or in the cloud in various formats once you finish making adjustments. Managing your Get IRS 990 - Schedule R 2017 in our robust online editor is the most efficient and effective method to handle, submit, and share your documentation precisely how you require it from anywhere. The tool operates from the cloud, enabling use from any location on any internet-enabled device. All forms you generate or complete are securely stored in the cloud, so you can access them whenever necessary, ensuring you won't lose them. Stop wasting time on manual document filling and eliminate paperwork; accomplish everything online with minimal effort.

- Fill in the gaps using Text, Cross, Check, Initials, Date, and Sign selections.

- Emphasize important information with your preferred color or underline it.

- Conceal sensitive details using the Blackout feature or simply delete them.

- Insert images to illustrate your Get IRS 990 - Schedule R 2017.

- Substitute the original text with the adjustment that meets your needs.

- Add comments or sticky notes to engage with others regarding the modifications.

- Include additional fillable sections and assign them to designated individuals.

- Secure the template with watermarks, dates, and bates numbers.

Get form

Related links form

To find 990 filings online, you can access the IRS website or databases like GuideStar and ProPublica. These platforms provide easy access to a vast array of nonprofit documents, including the essential IRS 990 - Schedule R. Searching for these forms is straightforward, and you can view detailed financial reports and organizational information. This access helps you research or verify a nonprofit's compliance and operational history.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.