Get Mt Ui-5 2014-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MT UI-5 online

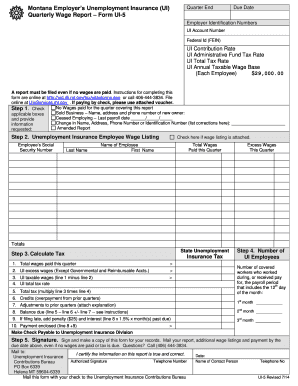

Filling out the Montana Employer’s Unemployment Insurance Quarterly Wage Report, known as Form UI-5, is essential for employers to report wages paid to employees. This guide provides clear, step-by-step instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to complete your UI-5 form online.

- Press the ‘Get Form’ button to access the MT UI-5 form and open it in your preferred online platform.

- Check the boxes for applicable sections, indicating whether you are reporting for a sold business, have ceased employing, or are submitting corrections for your name, address, phone number, or identification number. Provide the last payroll date if employing has ceased.

- Complete the Unemployment Insurance Employee Wage Listing section by entering each employee's first name, last name, Social Security number, total wages paid for the quarter, and any excess wages. If you have an attached wage listing, be sure to check the box.

- Calculate the unemployment insurance tax. First, determine the total wages paid, then subtract any UI excess wages to find UI taxable wages. Use the UI total tax rate to calculate the total tax owed. Include any credits for overpayments from prior quarters and adjustments for prior quarters as necessary.

- Indicate the number of UI employees and list the months covered by the report, ensuring accuracy for each payroll period.

- Make a payment if applicable, adding any penalties or interest for late filings to the balance due.

- Sign the form indicating that the information is true and correct. Make a copy for your records.

- Mail your completed report, any additional wage listings, and payment to the Unemployment Insurance Contributions Bureau by the specified due date.

Complete your MT UI-5 form online today to ensure compliance and timely reporting.

To register as an employer in Montana, you need to complete the necessary paperwork with the Montana Department of Labor and Industry. This includes providing details about your business and understanding your obligations under the MT UI-5 program. The process can seem daunting, but platforms like UsLegalForms make it easy by providing clear guidance and templates. This can save you time and help ensure all compliance issues are addressed.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.