Loading

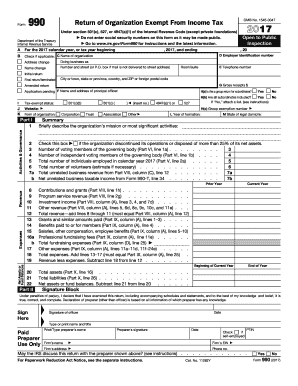

Get Irs 990 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 online

Filing the IRS Form 990 is a crucial step for organizations that qualify as tax-exempt. This guide provides a step-by-step approach to ensure you complete the form accurately and efficiently, helping you comply with internal revenue regulations.

Follow the steps to fill out the IRS 990 online successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the calendar year for which you are filing the form in part A. Be precise about the starting and ending dates.

- Fill out section C by providing the name of the organization, the employer identification number, and check applicable boxes for changes in address or name.

- In section D, provide the address of the organization. Ensure the details are complete with street, city, state, and ZIP code.

- Complete the telephone number and principal officer’s name and address in section F.

- In section G, indicate gross receipts and check if this is an amended return or an initial return for the current tax year.

- Move to Part I and summarize the mission and significant activities of the organization. Operate within the character limits specified.

- Proceed to fill out Parts II through XII as required, detailing expenditures, revenue, and governance information as applicable to your organization.

- After completing all relevant sections, review for accuracy and completeness. Confirm that no personal information, like social security numbers, is included.

- Finally, save your changes, download the completed form, print a copy for your records, or share it with relevant stakeholders.

Complete your IRS 990 forms online today to ensure compliance and maintain your organization’s tax-exempt status.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, the IRS Form 990 is considered a public record. This means anyone can access these documents, unless a specific exemption applies. Organizations must provide copies of their Form 990 upon request, promoting transparency within the nonprofit sector. For those interested in viewing these forms, you can often find them on the IRS website or through nonprofit data aggregators.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.