Get Ut Uar Seller Financing Addendum Repc Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT UAR Seller Financing Addendum REPC Form online

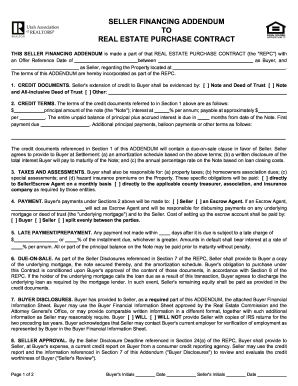

The UT UAR Seller Financing Addendum REPC Form is an essential document in real estate transactions involving seller financing. This user-friendly guide will provide you with a clear pathway on how to complete this form online, ensuring you understand each section and field.

Follow the steps to successfully complete the form.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Begin by filling in the Offer Reference Date, identifying the Buyer and Seller's names, and specifying the Property's address.

- In Section 1, select the type of credit document that will evidence the seller's extension of credit by checking the appropriate box.

- Enter the details pertaining to the credit terms in Section 2, including the principal amount, interest rate, payment schedule, and any additional terms like balloon payments.

- Move to Section 3 to identify who will be responsible for property-related payments such as taxes and insurance, and check the appropriate box for payment responsibility.

- In Section 4, indicate whether payment will be made directly to the Seller or through an Escrow Agent by selecting the correct option.

- Complete Section 5 with details regarding late payment fees and prepayment provisions, including applicable interest rates if payments are late.

- Review Section 6, which pertains to the due-on-sale clause and Buyer obligations. Ensure to complete any required statements.

- In Section 7, detail the Buyer Disclosures, including whether copies of IRS returns will be provided to the Seller.

- Fill out Section 9 regarding the provision of title insurance, checking the appropriate box based on the Buyer’s decision.

- Finalize the form by obtaining signatures from both Buyer and Seller, including their Social Security Numbers if required.

- Once completed, ensure you save changes and choose to download, print, or share the form as necessary.

Start filling out your UT UAR Seller Financing Addendum REPC Form online today for a smoother real estate transaction.

A buyer representation agreement defines the relationship between a buyer and their real estate agent, clarifying what services the agent will provide. This agreement protects the buyer’s interests throughout the home purchasing process. When coupled with the UT UAR Seller Financing Addendum REPC Form, buyers gain additional security regarding seller financing terms. Establishing this agreement helps facilitate smoother negotiations.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.