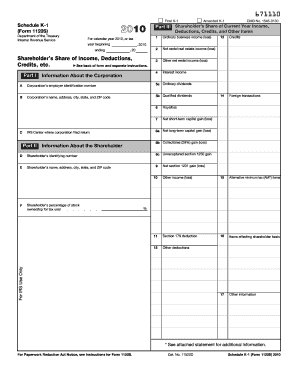

Get Irs 1120s - Schedule K-1 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1120S - Schedule K-1 online

How to fill out and sign IRS 1120S - Schedule K-1 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When individuals aren’t linked to document management and legal operations, completing IRS forms can be incredibly stressful.

We fully understand the significance of accurately finalizing documents.

Utilizing our platform will turn the professional completion of IRS 1120S - Schedule K-1 into a reality, ensuring a comfortable and secure working environment.

- Click on the button Get Form to access it and start editing.

- Fill in all necessary fields in the chosen document using our robust and user-friendly PDF editor. Activate the Wizard Tool to simplify the process even further.

- Ensure the accuracy of the entered information.

- Include the date of completing IRS 1120S - Schedule K-1. Use the Sign Tool to generate your unique signature for document validation.

- Conclude editing by clicking Done.

- Submit this document directly to the IRS in the most convenient way for you: via email, digital fax, or mail.

- You have the option to print it out on paper if a copy is needed and download or save it to your preferred cloud storage.

How to alter Get IRS 1120S - Schedule K-1 2010: personalize forms online

Provide the appropriate document alteration capabilities at your fingertips. Carry out Get IRS 1120S - Schedule K-1 2010 with our reliable tool that integrates editing and eSignature functionalities.

If you wish to implement and authenticate Get IRS 1120S - Schedule K-1 2010 online without any hassle, then our web-based solution is the optimal choice. We present a comprehensive template-based library of ready-to-use documents you can modify and finalize online. Additionally, there is no requirement to print the form or utilize third-party tools to make it fillable. All necessary tools will be readily accessible as soon as you open the document in the editor.

Modify and comment on the template

The upper toolbar includes tools that assist you in emphasizing and obscuring text, excluding images and visual components (lines, arrows, and checkmarks, etc.), adding your signature, initialing, dating the form, and more.

Organize your documents

- Explore our online editing features and their key functionalities.

- The editor possesses an intuitive interface, so it won't require much time to grasp how to utilize it.

- Let’s examine three primary sections that enable you to:

Get form

The entity responsible for filing IRS Schedule K-1 is typically the S Corporation itself, which reports the income, deductions, and credits attributed to each shareholder. You'll receive a copy of K1 from the S Corporation, which you then use for your personal tax filings. It's crucial to keep this document handy, as it directly influences your tax return. If you have concerns about your filings, uslegalforms can assist in clarifying your responsibilities.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.