Loading

Get Irs Form 8932 2019

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Form 8932 online

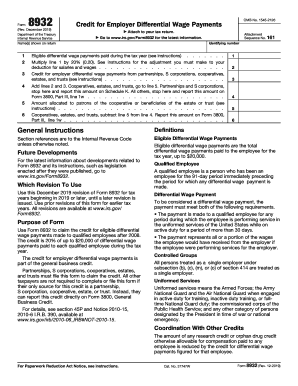

Filling out IRS Form 8932 online can seem daunting, but this guide will help you through each section step by step. This form is essential for claiming the credit for eligible differential wage payments made to qualified employees.

Follow the steps to successfully complete the IRS Form 8932 online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name(s) shown on the return. This information identifies the entity or person filing the form.

- Provide your identifying number in the appropriate field, which is typically your employer identification number (EIN) or social security number (SSN).

- On line 1, input the total amount of eligible differential wage payments made to qualified employees during the tax year. Remember, this amount must not exceed $20,000 for any employee.

- On line 2, calculate 20% of the amount reported on line 1 and enter this amount. This reflects the adjustment needed for your deduction for salaries and wages.

- Next, on line 3, enter any credit for employer differential wage payments that comes from partnerships, S corporations, cooperatives, estates, or trusts by following the appropriate guidelines.

- For line 4, add the amounts from lines 2 and 3. Note that partnerships and S corporations will report this figure on Schedule K, while others will report it on Form 3800.

- If applicable, on line 5, enter the amount of the credit allocated to patrons of cooperatives or beneficiaries of estates or trusts. Ensure it is accurately calculated.

- Finally, review all entries for accuracy. Once confirmed, you can save changes, download, print, or share the completed form as required.

Take the next step and confidently complete your IRS Form 8932 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

IRS Form 2553 is used by small businesses to elect to be treated as an S corporation for tax purposes. Making this election can provide tax benefits, such as avoiding double taxation on corporate earnings. While IRS Form 8932 pertains to different tax credits, both forms play important roles in optimizing a business's tax strategy.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.