Loading

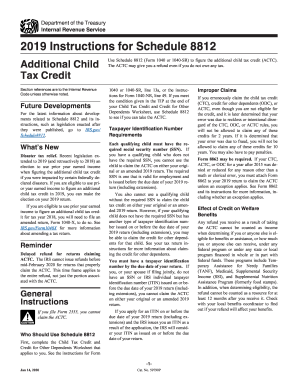

Get Irs 1040 Schedule 8812 Instructions 2019

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1040 Schedule 8812 Instructions online

Filling out the IRS 1040 Schedule 8812 is essential for determining eligibility for the additional child tax credit. This guide provides clear, step-by-step instructions to help users complete the form online with ease.

Follow the steps to successfully complete your Schedule 8812 online.

- Press the ‘Get Form’ button to download the Schedule 8812 form and open it in your preferred editor.

- Begin by reviewing the introductory sections of the form, ensuring you understand who should use Schedule 8812 and any eligibility requirements. Make sure each qualifying child has a valid social security number.

- Complete part I for all filers. On line 6a, enter your earned income based on the Earned Income Chart and any applicable disaster relief provisions. If eligible, make sure to use your prior year earned income as instructed.

- On line 6b, input your total nontaxable combat pay if applicable. This information can be found on Form W-2.

- Move to part II if you have three or more qualifying children, completing line 9 by following the Line 9 Worksheet instructions carefully.

- Once you have filled out all necessary fields and sections, review your entries for accuracy to avoid any errors.

- Lastly, save your changes, then download, print, or share your completed form as required.

Start filling out your IRS 1040 Schedule 8812 online today to ensure you receive the credits you deserve.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The Child Tax Credit is reported on line 21 of the IRS 1040 form. For accurate reporting, consult the IRS 1040 Schedule 8812 Instructions, as they provide necessary details for calculating the credit. Properly identifying this credit can lead to increased tax benefits. This process is important for maximizing your overall tax return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.