Loading

Get Irs Instructions For Employee Copies Of W-2 Forms 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IRS Instructions for Employee Copies of W-2 Forms online

Filling out your IRS Instructions for Employee Copies of W-2 Forms online can seem daunting, but with the right guidance, it becomes a manageable task. This guide provides clear, step-by-step instructions to help you navigate each section of the form effectively.

Follow the steps to fill out the form correctly.

- Use the 'Get Form' button to obtain the form and open it for editing.

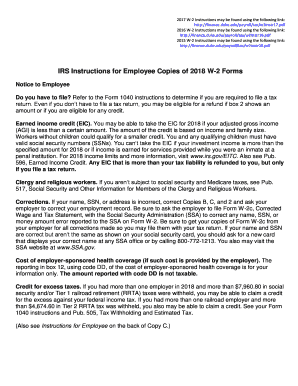

- Review the notice to employees at the top of the form, which provides essential information regarding filing requirements and potential refunds for eligible users.

- Look at Box 1, and enter the amount from this box on the wages line of your tax return.

- In Box 2, enter the amount corresponding to federal income tax withheld on your tax return.

- Assess Box 5, as you may need to report this amount on Form 8959, Additional Medicare Tax, if applicable.

- Check Box 6 for the Medicare Tax details collected; it includes both Medicare tax and any additional Medicare tax on higher wages.

- Review Box 8 regarding allocated tips. Ensure to file Form 4137 if you need to report unreported tip income.

- For Box 9, if you are e-filing and see a code, remember to enter it correctly as prompted.

- In Box 10, report dependent care benefits according to the guidance provided, and complete Form 2441 if necessary.

- In Box 12, identify any codes relevant to your contributions and ensure these are documented by contacting your plan administrator if necessary.

- For Box 13, check if the retirement plan box is marked, which may affect your IRA contribution deductions.

- Examine Box 14 for any additional employer-reported information such as state disability taxes or union dues.

- Save your changes to the form, and then download, print, or share the final document as needed.

Complete your IRS Instructions for Employee Copies of W-2 Forms online today to ensure timely and accurate submission.

If you prefer not to contact your employer, check if they have an online payroll system that allows you to view or download your W-2. Many companies partner with services like ADP or other payroll providers, which offer easier access to tax documents. Always consult the IRS Instructions for Employee Copies of W-2 Forms to thoroughly understand your options.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.