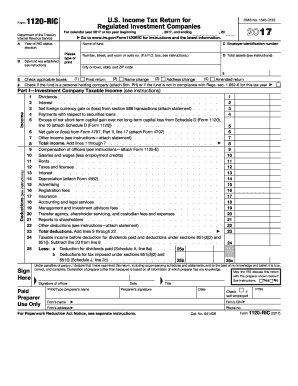

Get Irs 1120-ric 2017

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 1120-RIC online

How to fill out and sign IRS 1120-RIC online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When individuals aren’t linked to documentation management and legal procedures, completing IRS documents can be quite stressful.

We completely understand the importance of accurately filling out documents.

Utilizing our comprehensive solution will facilitate professional completion of IRS 1120-RIC. We will handle everything for your ease and speedy work.

- Press the button Get Form to access it and start editing.

- Fill in all required fields in the document using our user-friendly PDF editor. Activate the Wizard Tool to make the process even simpler.

- Verify the accuracy of the information entered.

- Add the date of completing IRS 1120-RIC. Use the Sign Tool to affix your signature for document validation.

- Finish editing by clicking on Done.

- Submit this document directly to the IRS in the most convenient manner for you: via email, using digital fax, or postal service.

- You can print it on paper if a hard copy is necessary and download or save it to your desired cloud storage.

How to modify Get IRS 1120-RIC 2017: personalize forms online

Place the appropriate document editing tools within your reach. Carry out Get IRS 1120-RIC 2017 with our dependable service that offers editing and eSignature capabilities.

If you wish to process and sign Get IRS 1120-RIC 2017 online effortlessly, then our cloud-based solution is the ideal choice. We offer an extensive template library of ready-to-customize paperwork that you can complete online. Additionally, you won't need to print the document or utilize external solutions to make it fillable. All necessary tools will be accessible once you load the document in the editor.

Let’s look into our online editing features and their primary components. The editor has a user-friendly interface, so it won’t take much time to learn how to navigate it. We’ll review three essential sections that allow you to:

Beyond the features mentioned earlier, you can protect your document with a password, add a watermark, convert the file to your required format, and much more.

Our editor facilitates modifying and validating the Get IRS 1120-RIC 2017 with ease. It allows you to accomplish virtually everything required when it comes to handling forms. Furthermore, we consistently ensure that your experience managing files is safe and compliant with primary regulatory standards. All these factors make using our tool even more enjoyable.

Obtain Get IRS 1120-RIC 2017, implement the necessary modifications and refinements, and receive it in the preferred file format. Try it out today!

- Revise and annotate the template

- The upper toolbar contains tools that enable you to emphasize and obscure text, without any graphics or visual elements (lines, arrows, checkmarks, etc.), include your signature, initialize, date the document, and more.

- Manage your documents

- Utilize the left toolbar if you want to rearrange the document or remove pages.

- Prepare them for distribution

- If you'd like to make the template fillable for others and share it, you can use the tools on the right to insert various fillable fields, signatures, date, text boxes, etc.

Get form

Related links form

RIC ownership requirements focus on shareholder qualifications and distribution needs. To qualify, a RIC must have at least 100 shareholders and meet asset diversification standards. Additionally, RICs should distribute significant income to maintain favorable tax treatment. Understanding these requirements is crucial, and platforms like US Legal Forms can assist in navigating this complex landscape.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.