Get Irs 8879-c 2019

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8879-C online

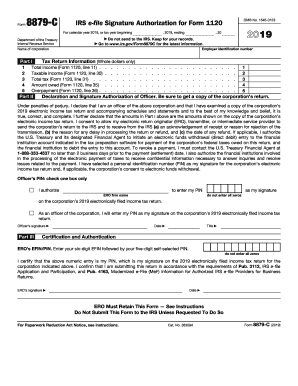

The IRS 8879-C is an essential form for corporate officers, enabling them to electronically sign a corporation’s income tax return using a personal identification number (PIN). This guide provides step-by-step instructions to help users confidently fill out the form online.

Follow the steps to properly complete the IRS 8879-C

- Click ‘Get Form’ button to obtain the form in your preferred editor. This allows you to easily access the information needed for completion.

- Begin with Part I by entering the corporation's employer identification number and name at the top of the form. Next, fill in the tax return information by transferring the relevant totals directly from Form 1120: total income, taxable income, total tax, amount owed, and overpayment, ensuring all amounts are in whole dollars.

- Proceed to Part II, where the corporate officer must declare that they have reviewed the corporation’s 2019 electronic income tax return. They should confirm the accuracy of the amounts provided in Part I. This section also includes consent for the electronic return originator (ERO) to send the return to the IRS and manage the receipt and potential payment details.

- In Part II, the officer must specify how they will authorize their PIN. They can either authorize the ERO to enter the PIN or choose to do it themselves. If opting for the ERO to enter the PIN, be sure to write the ERO firm name without mentioning preparer's personal name.

- The corporate officer must sign and date the form, including their title to complete Part II. Confirmation of these details will help ensure the authenticity of the submission.

- In Part III, the ERO must provide their own EFIN and a self-selected PIN, confirming that their entry serves as their signature on the return. The ERO also needs to date the form.

- Once filled out, the officer should review the form carefully to ensure all information is accurate before sending it back to the ERO. The ERO must retain the completed form in their records but does not submit it to the IRS unless requested.

- Finally, you can save the changes made to the form, download it in the desired format, print a physical copy, or share it with relevant parties as needed.

Start completing your IRS 8879-C online today to ensure timely and accurate filing.

Get form

Related links form

The primary difference between IRS Form 8879-C and Form 8453-C lies in their purpose. Form 8879-C is used specifically for electronic filing of corporate tax returns, while Form 8453-C is a declaration of electronic filing that may also include paper attachments. Both forms are vital for corporate tax compliance. Understanding these differences can help ensure you use the correct form; UsLegalForms can assist in clarifying your filing needs.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.