Loading

Get Irs 8804 2019

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8804 online

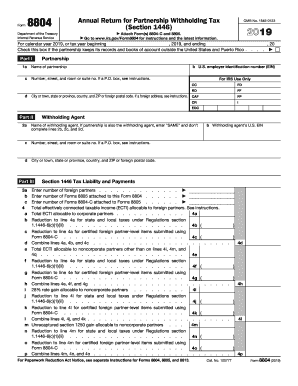

The IRS Form 8804 is an essential document for partnerships engaged in withholding tax. This guide provides clear, step-by-step instructions on how to complete this form online, designed for both experienced users and those new to tax forms.

Follow the steps to fill out the IRS 8804 online.

- Click the ‘Get Form’ button to access the form and open it in your preferred editor.

- Begin by filling out Part I. Enter the name of the partnership in the designated field, followed by their U.S. employer identification number (EIN). Provide the partnership's address, including the street number and any suite numbers. Finish this section by entering the city, state, and ZIP code.

- Next, proceed to Part II. If the partnership serves as the withholding agent, indicate 'SAME' in the corresponding field and leave the other fields blank. Otherwise, provide the name and address of the withholding agent.

- In Part III, indicate the number of foreign partners and the number of Forms 8805 attached to this Form 8804. Note the total effectively connected taxable income (ECTI) allocable to foreign partners and any specific breakdowns required by the form's instructions.

- Calculate the gross section 1446 tax liability by completing all relevant line items in this section according to the instructions provided. Remember to check for any necessary reductions for state and local taxes.

- Complete any fields regarding payments made or withheld concerning section 1446 tax, ensuring you include all amounts reported on Forms 8805 and any other related forms.

- Review the calculations for balance due or overpayment on line entries 11 to 13. Ensure that these figures are accurate, as they determine your final tax obligations.

- Once all sections are completed, review the information for accuracy. Save any changes, then download or print the filled form for submission.

Complete your IRS 8804 form online today for a streamlined tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

If you are mailing form 941 with payment to the IRS, make sure to send it to the designated address in the filing instructions. Depending on whether you are including a payment or not, the address may differ. Always confirm the latest information with the IRS to ensure proper delivery.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.