Get Irs 1120 Schedule M-3 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120 Schedule M-3 online

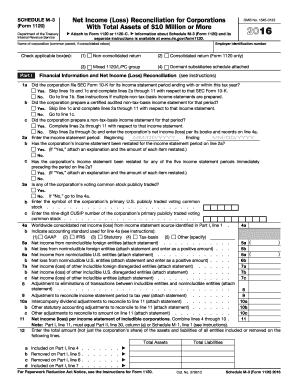

This guide provides a comprehensive overview of how to accurately complete the IRS 1120 Schedule M-3 online. Designed for users at all experience levels, this resource will walk you through each section and field of the form to ensure a smooth filing process.

Follow the steps to successfully complete your IRS 1120 Schedule M-3 online

- Click ‘Get Form’ button to obtain the form and open it in your browser.

- Fill in your employer identification number and the name of the corporation at the top of the form.

- Select the appropriate box under 'Check applicable box(es)' to indicate whether the return is non-consolidated, consolidated, or other.

- In Part I, address line 1 regarding whether the corporation filed SEC Form 10-K. If yes, complete lines 2a through 11 based on that form.

- If SEC Form 10-K is not applicable, proceed to line 1b to check if a certified audited non-tax-basis income statement was prepared, and follow the respective instructions accordingly.

- Complete line 2a by entering the income statement period's beginning and ending dates.

- Address whether the income statement has been restated in lines 2b and 2c, attaching explanations if necessary.

- In line 4a, report the worldwide consolidated net income (loss) from the identified source. Indicate the accounting standard used in line 4b.

- Continue filling out the sources of income and losses as indicated in lines 5 through 10, attaching any necessary statements.

- Once all lines in Part I are completed, ensure that the total from Part I, line 11 matches the corresponding totals in Part II or Schedule M-1.

- Proceed to Part II for reconciliation of net income, entering numbers for various income and loss categories as they apply.

- In Part III, enter the expense and deduction items as per the income statement, ensuring all numbers correlate with the provided instructions.

- Review the entire form for accuracy before submitting it through the online filing method, ensuring that any required attachments are included.

- Finally, save your changes, download, print, or share the completed IRS 1120 Schedule M-3 as necessary.

Start your online filing of IRS 1120 Schedule M-3 today to ensure compliance with tax regulations.

Get form

To file an 1120 tax return, gather all necessary financial documentation, including income statements, balance sheets, and expenses. You'll need to complete the IRS 1120 form and any applicable schedules, such as the IRS 1120 Schedule M-3, if required. Consider using platforms like US Legal Forms for guidance and templates that simplify the filing process, ensuring you're accurately reporting your corporate income.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.