Get Nyc Dof Att-s-corp 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC DoF ATT-S-CORP online

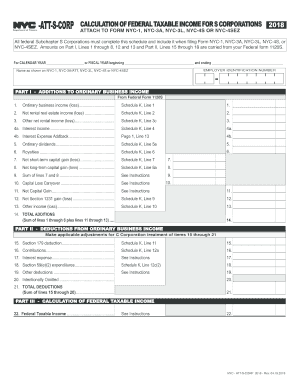

Completing the NYC DoF ATT-S-CORP form is essential for federal Subchapter S Corporations to report their taxable income accurately. This guide will provide you with a clear and step-by-step approach to filling out this form online, ensuring you meet all necessary requirements.

Follow the steps to successfully complete the NYC DoF ATT-S-CORP form online.

- Use the ‘Get Form’ button to obtain the form and open it for editing.

- Begin by entering the calendar year or fiscal year for which you are filing the report. This helps to clarify the reporting period.

- Fill in your company name as it appears on the NYC-1, NYC-3A, NYC-3L, NYC-4S, or NYC-4SEZ form.

- Input your Employer Identification Number (EIN) in the designated field.

- For Part I, list all additions to ordinary business income. Complete each line as required, recording figures from your federal Form 1120S where indicated.

- In Part II, provide deductions from ordinary business income, including any necessary adjustments for C Corporation treatment. Follow line instructions carefully.

- Move to Part III to calculate your federal taxable income by subtracting total deductions from total additions.

- Review all sections for accuracy and completeness before proceeding.

- Once completed, you have the option to save changes, download, print, or share the form as needed.

Start completing your NYC DoF ATT-S-CORP form online today!

Get form

Related links form

Yes, you can set up an S Corp yourself in NYC, but the process requires careful attention to detail. You will need to research state regulations, complete necessary forms, and meet filing deadlines. While it is possible to do this independently, many people find that using a service such as US Legal Forms simplifies the process and helps avoid mistakes. This support can be especially beneficial when dealing with the nuances of NYC DoF ATT-S-CORP.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.