Loading

Get Nyc Dof Att-s-corp 2018

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NYC DoF ATT-S-CORP online

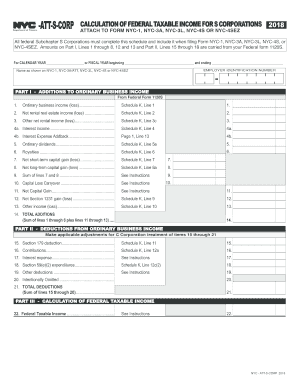

Filling out the NYC DoF ATT-S-CORP form is essential for federal Subchapter S Corporations to calculate their taxable income. This guide provides a clear, step-by-step approach to assist users in completing the form accurately and efficiently.

Follow the steps to complete the NYC DoF ATT-S-CORP form online.

- Press the ‘Get Form’ button to access the NYC DoF ATT-S-CORP form and open it in your preferred editor.

- Begin by filling in the calendar year or fiscal year dates. Ensure that the name shown on your other NYC Forms is accurately stated.

- Locate Part I, where you will report additions to ordinary business income. Fill in lines 1 to 14 with the appropriate amounts from your Federal form 1120S and any applicable adjustments.

- Proceed to Part II to detail deductions from ordinary business income. Complete lines 15 to 21, which include various deductions such as Section 179 deduction and interest expenses.

- Move to Part III, where you will calculate the federal taxable income. Subtract the total deductions in Part II from the total additions in Part I to arrive at your federal taxable income.

- Once all sections are filled out accurately, review the form for any errors or omissions. Save your changes to ensure no information is lost.

- Finally, download or print the completed form as needed, or share it according to your reporting requirements.

Complete your NYC DoF ATT-S-CORP form online today to ensure accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

S corporations in New York offer several advantages, including avoiding double taxation, which can lead to significant tax savings. They also provide personal liability protection for owners. Leveraging the NYC DoF ATT-S-CORP can help you ensure that your business complies with state laws while enjoying these benefits.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.