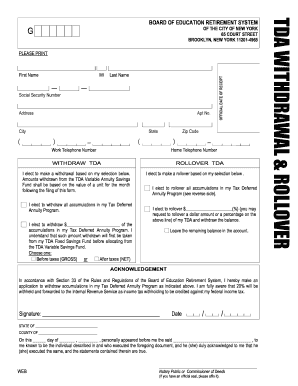

Get Ny Tda Withdrawal & Rollover

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign NY TDA Withdrawal & Rollover online

How to fill out and sign NY TDA Withdrawal & Rollover online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Currently, the majority of Americans prefer to handle their own income tax and, in reality, to complete forms electronically.

The US Legal Forms online service simplifies and streamlines the procedure of e-filing the NY TDA Withdrawal & Rollover.

Ensure that you have accurately filled out and submitted the NY TDA Withdrawal & Rollover by the deadline. Pay attention to any due dates. Providing incorrect information on your financial documents may lead to substantial penalties and complications with your annual tax return. Be certain to use only authorized templates with US Legal Forms!

- Examine the PDF example in the editor.

- Look at the underlined fillable sections where you can enter your details.

- Select the option when you see the checkboxes.

- Navigate to the Text tool along with various advanced options to manually modify the NY TDA Withdrawal & Rollover.

- Confirm all the details prior to proceeding to sign.

- Create your personalized eSignature using a keypad, camera, touchpad, mouse, or mobile device.

- Verify your web template online and insert the date.

- Click on Done to proceed.

- Download or forward the document to the addressee.

How to modify Get NY TDA Withdrawal & Rollover: personalize forms online

Your swiftly adjustable and customizable Get NY TDA Withdrawal & Rollover template is within easy access. Take advantage of our collection equipped with an integrated online editor.

Do you delay completing Get NY TDA Withdrawal & Rollover because you simply don't know where to start and how to go about it? We comprehend your sentiment and have an excellent solution for you that has nothing to do with overcoming your delays!

Our online directory of ready-to-use templates enables you to browse and select from thousands of fillable forms tailored for a variety of purposes and situations. However, obtaining the file is merely the beginning. We furnish you with all the essential tools to complete, validate, and alter the form you choose without exiting our platform.

All you need to do is open the form in the editor. Review the wording of Get NY TDA Withdrawal & Rollover and confirm whether it's what you’re seeking. Begin modifying the template by utilizing the annotation tools to give your form a more orderly and polished appearance.

In summary, alongside Get NY TDA Withdrawal & Rollover, you'll receive:

With our professional tool, your completed forms are always legally binding and fully encrypted. We assure you that your most sensitive information is protected.

Obtain what you require to create a professionally appealing Get NY TDA Withdrawal & Rollover. Make the right decision and try our platform today!

- Add ticks, circles, arrows, and lines.

- Highlight, obscure, and amend the existing text.

- If the form is meant for others as well, you can incorporate fillable fields and share them for others to complete.

- Once you’re finished altering the template, you can obtain the document in any available format or select any sharing or delivery methods.

- A powerful array of editing and annotation tools.

- An integrated legally-binding eSignature feature.

- The capability to create forms from scratch or based on the pre-designed template.

- Compatibility with various platforms and devices for enhanced convenience.

- Multiple options for securing your files.

- An extensive range of delivery options for smoother sharing and dispatching files.

- Adherence to eSignature regulations governing the use of eSignature in online transactions.

Related links form

You can transfer your TSP funds without incurring penalties by following the correct procedures. A direct transfer to an eligible retirement account, such as an IRA, allows you to maintain tax-deferred status. It's important to complete the necessary paperwork accurately to ensure compliance with regulations. At USLegalForms, we provide clear guidance to help you navigate the NY TDA Withdrawal & Rollover process smoothly, avoiding any potential pitfalls.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.