Loading

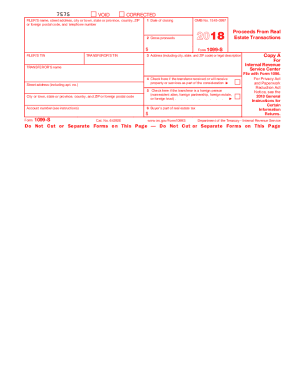

Get Irs 1099-s 2018

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-S online

Filling out the IRS 1099-S form is an important step for reporting proceeds from real estate transactions. This guide will provide clear, step-by-step instructions on how to complete the form online effectively.

Follow the steps to complete the IRS 1099-S form online.

- Press the ‘Get Form’ button to obtain the IRS 1099-S form and open it in your preferred editor.

- In the designated field, enter your name, address, city or town, state or province, country, ZIP or foreign postal code, and telephone number to identify yourself as the filer.

- Input the date of closing in Box 1, which indicates when the real estate transaction occurred.

- In Box 2, record the gross proceeds from the real estate transaction, which is typically the sales price. This should include cash, notes payable, and any other financial considerations.

- Provide the address or legal description of the property transferred in Box 3.

- If applicable, check Box 4 to indicate whether the transferor received or will receive property or services as part of the consideration.

- Check Box 5 if the transferor is a foreign person, such as a nonresident alien or foreign partnership.

- In Box 6, indicate the buyer's part of the real estate tax, if applicable. Make sure to account for any deductions you have already claimed.

- Once all fields are completed, save any changes. You may then download the form, print it, or share it as necessary.

Complete your IRS 1099-S form online today to ensure your real estate transactions are accurately reported.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To report an IRS 1099-S on your tax return, you will need to fill out Form 1099-S and enter the relevant details about the real estate transaction. If you have capital gains or losses from the sale, you will also need to complete Schedule D. This structured approach helps you provide the IRS with accurate information regarding your transactions. Consider platforms like USLegalForms for support in navigating these forms.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.