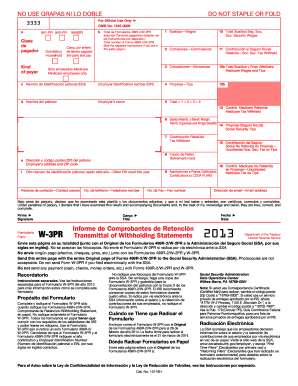

Get Irs W-3pr 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS W-3PR online

How to fill out and sign IRS W-3PR online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Documenting your income and submitting all the necessary tax filings, including IRS W-3PR, is solely the duty of a US citizen. US Legal Forms makes your tax preparation more accessible and accurate.

You can obtain any legal templates you need and complete them digitally.

Store your IRS W-3PR safely. Ensure that all your accurate documents and records are organized while keeping in mind the deadlines and tax regulations established by the Internal Revenue Service. Simplify it with US Legal Forms!

- Obtain IRS W-3PR in your web browser from your device.

- Access the editable PDF file with a click.

- Start filling out the template field by field, following the prompts of the advanced PDF editor's interface.

- Carefully input text and numbers.

- Click on the Date field to automatically set today’s date or modify it manually.

- Use the Signature Wizard to create your personalized e-signature and verify within minutes.

- Consult the Internal Revenue Service guidelines if you still have inquiries.

- Click Finish to preserve the modifications.

- Continue to print the document, download it, or send it via email, text message, fax, or mail without leaving your browser.

How to Modify Get IRS W-3PR 2013: Personalize Documents Online

Experience the ease of the feature-rich online editor while finalizing your Get IRS W-3PR 2013. Utilize the assortment of tools to swiftly fill in the gaps and provide the necessary information in no time.

Preparing documentation can be labor-intensive and costly unless you possess pre-made fillable templates and can finalize them electronically. The simplest method to handle the Get IRS W-3PR 2013 is to utilize our professional and multifaceted online editing services. We offer you all the crucial tools for rapid form completion and enable you to make modifications to your forms, tailoring them to any specifications. Furthermore, you can annotate the alterations and leave messages for other stakeholders involved.

Here’s what you can accomplish with your Get IRS W-3PR 2013 in our editor:

Managing the Get IRS W-3PR 2013 in our robust online editor is the fastest and most effective way to handle, submit, and disseminate your documents according to your requirements from anywhere. The tool functions in the cloud, allowing access from any location on any internet-enabled device. All forms you develop or prepare are securely stored in the cloud, so you can always retrieve them whenever necessary and be assured of not losing them. Stop squandering time on manual document creation and eliminate paper; accomplish everything online with minimal effort.

- Fill in the blanks using Text, Cross, Check, Initials, Date, and Sign instruments.

- Emphasize significant details with a chosen color or underline them.

- Conceal sensitive data using the Blackout feature or simply eliminate it.

- Add images to illustrate your Get IRS W-3PR 2013.

- Replace the original text with one that meets your needs.

- Include comments or sticky notes to communicate updates with others.

- Create additional fillable fields and designate them to specific individuals.

- Secure the document with watermarks, include dates, and bates numbers.

- Distribute the document in various methods and store it on your device or in the cloud in multiple formats after adjustments are complete.

Get form

8BEN is tailored for individual foreign persons, while 8BENE is meant for foreign entities such as corporations and partnerships. Both forms serve the same purpose of claiming tax treaty benefits, but they require different types of information. hen filing your tax documents, it’s important to use the appropriate form to avoid complications with the IRS 3PR reporting.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.