Loading

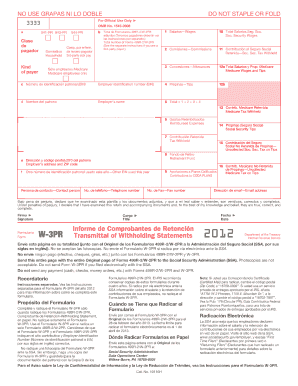

Get Irs W-3pr 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS W-3PR online

Completing the IRS W-3PR form online is a straightforward process that enables employers to report wage and withholding information accurately. This guide will provide you with clear, step-by-step instructions to ensure you complete the form correctly.

Follow the steps to fill out the IRS W-3PR form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Identify the kind of payer you are. In the form, select your designation from options such as household or third-party sick pay, as applicable.

- Enter your total number of Forms 499R-2/W-2PR in the designated field.

- In sections 1 through 8, input relevant data such as wages, commissions, tips, and any reimbursed expenses. Ensure these figures are accurate and represent the amounts reported in your Forms 499R-2/W-2PR.

- Provide your Employer Identification Number (EIN) and fill out your name, address, and ZIP code in their respective sections.

- Complete the declaration at the end of the form by signing and dating it. This declaration confirms that the information provided is accurate to the best of your knowledge.

- Finally, after all sections are filled out, review your entries for accuracy. You may then choose to save changes, download, print, or share the form as needed.

Start completing your IRS W-3PR form online today for accurate reporting!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Box 1 of the W-3 includes the total amount of wages, tips, and other compensation that you report on the accompanying W-2 forms. This figure is crucial as it represents the total taxable income for the reported employees. Be mindful that accurate reporting here is vital for adherence to IRS W-3PR standards.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.