Loading

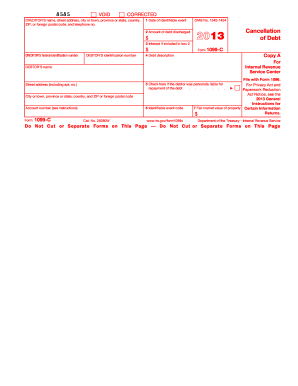

Get Irs 1099-c 2013

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1099-C online

Filling out the IRS 1099-C form can appear daunting, but this guide aims to simplify the process for users with varying levels of experience. This step-by-step tutorial will walk you through each section of the form, ensuring you understand the requirements for documenting the cancellation of debt.

Follow the steps to complete the IRS 1099-C online accurately.

- Press the ‘Get Form’ button to access the IRS 1099-C form online and open it in an appropriate editor.

- Begin filling in the creditor's information. This includes the creditor's name, address, and telephone number. Ensure that you enter the correct details as they will be used for identification purposes.

- Input the date of the identifiable event in Box 1. This date should reflect when the debt was discharged or the first identifiable event occurred.

- Enter the amount of the debt discharged in Box 2. Make sure to confirm this amount with your creditor if you have any doubts.

- If applicable, include any interest that is part of the discharged debt in Box 3. Follow IRS guidelines on whether to include this amount in your gross income.

- Provide a description of the debt in Box 4. This should detail the nature of the debt you are documenting.

- In Box 5, indicate whether or not the debtor was personally liable for repayment of the debt. Check the appropriate box.

- Fill out Box 6 with the identifiable event code that applies to your situation. Refer to IRS instructions for the specific code that fits your reason for debt cancellation.

- If applicable, complete Box 7 with the fair market value of any property involved in the debt cancellation, if a foreclosure or abandonment occurred.

- Review all entered information for accuracy, then save your changes. You can now download, print, or share the completed form as needed.

Complete your IRS 1099-C form online today to ensure timely and accurate reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

When it comes to a 1099-S, which reports real estate transactions, you should enter this information on Schedule D of your tax return. It’s important to report any gain or loss from the sale as indicated on this form. If you are uncertain, platforms like US Legal Forms can provide guidance on how to proceed with these entries.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.