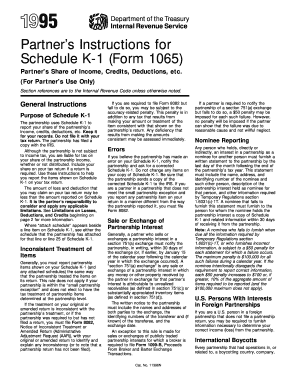

Get Irs Instruction 1065 - Schedule K-1 1995

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1065 - Schedule K-1 online

Filling out the IRS Instruction 1065 - Schedule K-1 online can be a complex process, but with careful attention to each section, you can ensure accurate reporting of your partnership income and deductions. This guide will provide step-by-step instructions for completing the form effectively.

Follow the steps to fill out the form with confidence.

- Press the ‘Get Form’ button to retrieve the form and open it for editing.

- Carefully enter your name, address, and taxpayer identification number in the designated fields at the top of the form.

- Review the sections labeled with your share of partnership income, credits, and deductions. Fill in the amounts as per your partnership agreement and corresponding schedules.

- If applicable, indicate any amounts related to tax-exempt income and nondeductible expenses in the appropriate boxes on the form.

- Complete the sections that require information on distributions made to you, ensuring that you accurately report cash and property amounts.

- Review the information on lines related to guarantees, losses, and other credits. Make sure to include notes or attachments if needed.

- After filling out the required fields, save your changes. You may then download the form for your records, print it, or share it as needed.

Complete your IRS forms online today for accuracy and convenience.

Get form

separately stated item refers to income or deductions that the partnership reports as a whole, without breaking it down for individual partners. For example, ordinary business income is generally a nonseparately stated item on Schedule K. Understanding these distinctions is vital when completing IRS Instruction 1065 Schedule K1 to ensure that all reporting is clear and accurate for each partner.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.