Loading

Get Irs Instruction 1065 - Schedule K-1 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 1065 - Schedule K-1 online

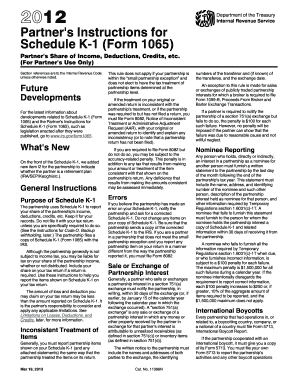

Filling out the IRS Instruction 1065 - Schedule K-1 online can seem daunting, but this guide simplifies the process. By following these structured steps, users can effectively report their share of partnership income, deductions, and credits.

Follow the steps to complete your Schedule K-1 efficiently.

- Press ‘Get Form’ button to access Schedule K-1 online. This will bring the form into your editing space.

- Begin with Part I, where you will input the 'Information About the Partnership.' Fill in the partnership's name, address, and Employer Identification Number (EIN). Ensure that item D indicates whether it is a publicly traded partnership if applicable.

- Proceed to Part II, 'Information About the Partner.' Here, include your name, address, and identifying number. Enter the percentages representing your share of the partnership, as well as any applicable information regarding termination of interest if necessary.

- In Part III, input your share of the current year income, deductions, credits, and other items. Carefully declare amounts shown in boxes 1 through 20, corresponding to the income or losses received. Be mindful of passive activity limits that may apply.

- Review the codes in box 13 for other deductions or items that are applicable. These may require specific action or additional forms based on what is reported.

- In the final segment of the form, ensure all details are accurate, especially regarding distributions in box 19 and any other relevant entries in box 20.

- Once you have verified the accuracy of all entries, you can save changes, download, print, or share the completed form as needed.

Complete your IRS documents online for efficiency and accuracy.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To enter Schedule 1 in TurboTax, navigate to the section dedicated to additional income and adjustments. This section allows you to include any relevant entries, such as those tied to IRS Instruction 1065 - Schedule K-1. Should you require extra assistance, using US Legal Forms can help you understand where to input these figures for maximum compliance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.