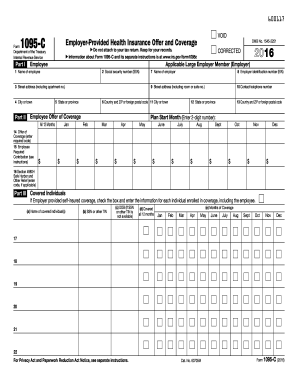

Get Irs 1095-c 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1095-C online

Filling out the IRS 1095-C form may seem daunting, but with the right guidance, you can successfully complete it online. This form provides essential information about the health coverage offered by your employer, which is important for your tax reporting.

Follow the steps to complete your IRS 1095-C online.

- Press the ‘Get Form’ button to access the form and open it for editing.

- In Part I, enter the employee information, including the employee's name, social security number (SSN), and addresses. Ensure that all provided information is accurate and complete.

- For the employer's details in Lines 7-13, fill in the employer's name and identification numbers. This information is crucial for accurate reporting.

- In Line 14, indicate the offer of health coverage by selecting the appropriate code that represents the coverage offered to the employee and their dependents.

- Complete Line 15 by entering the employee-required contribution for the lowest-cost self-only minimum essential coverage that is provided.

- In Line 16, enter the code that applies to the employer's shared responsibility provisions, which inform the IRS about coverage eligibility.

- In Part III, if applicable, check the box to indicate if employer-provided self-insured coverage is available. Then, list each covered individual’s name, SSN or other TIN, date of birth, and the months they were covered.

- After completing all sections, ensure all information is accurate, then save your changes. You can choose to download, print, or share the completed IRS 1095-C form as needed.

Complete your IRS 1095-C online today to ensure your health coverage information is accurately reported.

Get form

Related links form

While it’s not mandatory to have your IRS 1095-C to file your taxes, it's beneficial to refer to it. This form provides confirmation of your health insurance coverage throughout the year, which is important for accurate tax reporting. If your employer provided coverage, having the 1095-C can make the filing process smoother. You can ensure you do not miss any necessary information for your tax return.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.