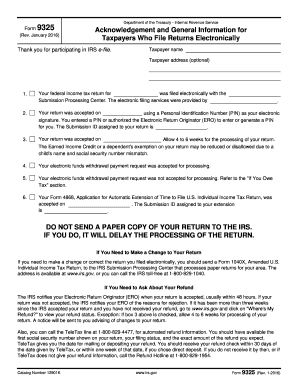

Get Irs 9325 2016

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 9325 online

How to fill out and sign IRS 9325 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If you aren't linked to document management and legal procedures, completing IRS forms can be quite stressful. We understand the importance of accurately finalizing paperwork. Our service provides the solution to simplify the process of filing IRS forms.

Follow these suggestions to swiftly and accurately complete IRS 9325.

Using our online platform will enable professional completion of IRS 9325. We will ensure everything is designed for your comfort and convenience.

- Click the button Get Form to access it and start editing.

- Complete all necessary fields in your document using our robust PDF editor. Activate the Wizard Tool to make the process even simpler.

- Confirm the accuracy of the information added.

- Include the date of completion for IRS 9325. Utilize the Sign Tool to create a unique signature for file authentication.

- Conclude editing by selecting Done.

- Submit this document directly to the IRS in the most convenient manner: via email, using digital fax, or postal service.

- You can print it on paper if a hard copy is required and download or save it to your preferred cloud storage.

How to modify Get IRS 9325 2016: personalize forms online

Put the correct document editing tools at your fingertips. Complete Get IRS 9325 2016 with our reliable solution that includes editing and eSignature features.

If you wish to finish and authenticate Get IRS 9325 2016 online without difficulties, then our web-based option is the solution you need. We offer a vast template-driven catalog of ready-to-use forms that you can edit and fill out online. Additionally, you won’t need to print the form or rely on third-party solutions to make it fillable. All the essential tools will be at your service once you access the document in the editor.

Let’s explore our online editing features and their primary functions. The editor boasts an intuitive interface, which makes it quick to learn how to use it. We’ll examine three main sections that allow you to:

In addition to the capabilities outlined above, you can secure your document with a password, add a watermark, convert the file to the desired format, and much more.

Our editor simplifies completing and certifying the Get IRS 9325 2016. It empowers you to handle virtually everything related to document management. Moreover, we consistently ensure that your experience working with files is safe and compliant with the primary regulatory standards. All these aspects make using our solution even more pleasurable.

Acquire Get IRS 9325 2016, implement the necessary changes and adjustments, and receive it in your preferred file format. Give it a shot today!

- Modify and annotate the template

- The upper toolbar contains the tools that assist you in emphasizing and obscuring text, excluding images and graphical elements (lines, arrows, checkmarks, etc.), sign, initial, date the document, and more.

- Arrange your documents

- Utilize the toolbar on the left if you want to rearrange the document or/and remove pages.

- Make them distributable

- If you wish to make the document fillable for others and share it, you can utilize the tools on the right to insert various fillable fields, signature and date, text box, etc.

Get form

When writing a letter of explanation to the IRS, start with your full name, address, and Social Security number at the top of the letter. Clearly explain the issue and provide any relevant context to help the IRS understand your situation. Include any supporting documentation if necessary, and be concise yet informative. Writing a well-organized letter ensures effective communication and increases your chances of a favorable outcome.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.