Loading

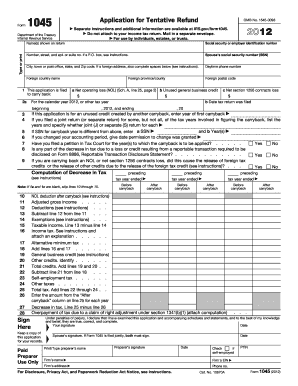

Get Irs 1045 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1045 online

The IRS 1045 form is used to apply for a tentative refund of overpaid taxes due to a net operating loss (NOL) carryback. This guide provides clear and supportive instructions on how to complete the IRS 1045 online, ensuring you can navigate the process with confidence.

Follow the steps to fill out the IRS 1045 online effectively.

- Click ‘Get Form’ button to obtain the IRS 1045 form and open it in the online editor.

- Enter your name(s) as shown on your tax return in the designated field at the top of the form.

- Fill in your Social Security Number or Employer Identification Number, along with your spouse’s SSN if applicable.

- Provide your mailing address, including city, state, and ZIP code. If you have a foreign address, complete the additional fields as specified.

- Indicate the type of application being filed for a carryback, including the relevant tax year dates.

- If applicable, provide information regarding the years for which you filed joint or separate returns.

- Complete the computation section for the decrease in tax due, including any necessary calculations as outlined in the instructions.

- Sign the application, and ensure both partners sign if filing jointly. Include the date of signature.

- Review all information for accuracy and completeness before proceeding.

- Once all fields are completed, save your changes, and choose to download, print, or share the completed form as needed.

Complete your IRS forms online today for a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, IRS Form 1045 can be filed electronically through various tax preparation software options approved by the IRS. E-filing this form simplifies the submission process and reduces the risk of errors. Using US Legal Forms can assist you in completing and filing your Form 1045 accurately and efficiently, ensuring quick processing.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.