Loading

Get Irs 8809 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8809 online

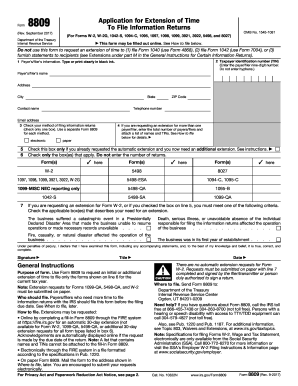

Filing Form 8809 is essential for payers and filers who need an extension of time to file specific information returns with the IRS. This guide provides clear, step-by-step instructions to help you successfully complete the form online.

Follow the steps to fill out the IRS 8809 form online.

- Press the ‘Get Form’ button to access the IRS 8809 form and open it in the online editor.

- In section 1, enter the payer's or filer's complete name and mailing address. Ensure that you provide the address where the IRS can send correspondence.

- For line 2, input the payer's or filer's nine-digit taxpayer identification number (TIN). This could be an employer identification number (EIN) or a social security number, depending on your situation. Avoid using hyphens.

- On line 3, check the box that corresponds to your method of filing information returns. You may choose either electronic or paper filing; only check one box.

- If you're requesting an extension for multiple payers or filers, enter the total number of entities on line 4 and attach a list of their names and TINs.

- Proceed to line 5. Check this box if you are requesting an additional extension after already obtaining the automatic 30-day extension. Make sure you meet the necessary criteria detailed in the form.

- In section 7, check all applicable boxes indicating your reason for requiring the extension, if you are filing for Form W-2.

- Sign and date the form. A signature is required only if you are requesting an additional extension or filing for Form W-2.

- Once all fields are completed, review the form for accuracy. You can then save changes, download, print, or share the completed form.

Complete your IRS 8809 submission online today for a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To determine if child support will take your tax refund, you should check with your local child support enforcement agency. They can provide specific information based on your payment history and current obligations. Staying informed can help you prepare for any potential interception of your refund.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.