Loading

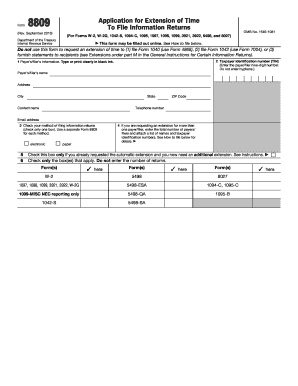

Get Irs 8809 2016

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8809 online

Filing an extension for information returns can be essential for accurate reporting. This guide will assist you in filling out the IRS 8809 form online, ensuring you understand each component and step required for smooth processing.

Follow the steps to successfully complete the IRS 8809 online form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by entering the payer's/filer's information in the designated fields. This includes providing the name, address, city, state, ZIP Code, contact name, telephone number, and email address clearly.

- Enter the taxpayer identification number, which is the nine-digit number without hyphens.

- Check the appropriate method of filing for the information returns by selecting either 'electronic' or 'paper'. Remember to use a separate Form 8809 for each method if applicable.

- If requesting an extension for multiple payers/filers, enter the total number and attach a list with the names and taxpayer identification numbers.

- If you have previously requested an automatic extension, check the corresponding box only if you need an additional extension.

- For certain forms, provide a detailed explanation for your extension request, ensuring to attach any additional sheets if necessary.

- Affix your signature, if required, and indicate the date and title. Remember that no signature is needed for the automatic 30-day extension.

- Review all information for accuracy, then save changes, download, or print the completed form as needed.

Start completing your IRS 8809 form online today to ensure timely filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To properly fill out a W9 form, ensure you write your name and business name accurately in the designated fields. Enter your correct address and your taxpayer identification number, whether it's your Social Security number or your EIN. It's also essential to sign and date the form, affirming the accuracy of the information. Platforms like US Legal Forms provide useful tips to ensure you get it right.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.