Loading

Get Irs 8809 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8809 online

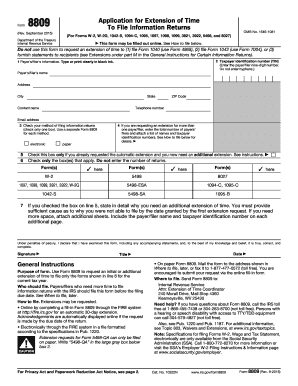

The IRS Form 8809 allows users to request an extension of time to file specific information returns. This guide provides clear, organized steps to effectively complete the form online, ensuring users have the necessary support to navigate the requirements.

Follow the steps to complete the IRS 8809 online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- Enter the payer's or filer's information. Clearly type or print the payer's or filer's name, complete address, city, state, ZIP code, contact name, telephone number, and email address in black ink.

- Provide the taxpayer identification number (TIN) in the specified field. This is the nine-digit number without hyphens.

- Select your method of filing information returns by checking the appropriate box for electronic or paper filing. If you are using multiple methods, a separate form is necessary for each.

- If requesting an extension for multiple payers or filers, enter the total number and attach a list with their names and TINs.

- If you have already received an automatic extension and need additional time, check the designated box and provide the reasoning in detail on line 7. Attach additional sheets if necessary.

- Confirm all information is accurate and complete. For an automatic 30-day extension, no signature is required. However, for additional extensions, ensure it is signed and dated by the payer, filer, or authorized representative.

- Finalize by saving any changes made, and review the option to download, print, or share the completed form.

Ensure your extensions are submitted correctly by completing the IRS 8809 online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

The IRS does not have a fixed percentage for what they will accept in an offer in compromise. Instead, they evaluate your financial situation, including income, expenses, and asset equity. It’s often beneficial to prepare a thorough application, as presenting your case clearly can improve your chances of acceptance by the IRS.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.