Loading

Get Irs 1041 - Schedule D 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1041 - Schedule D online

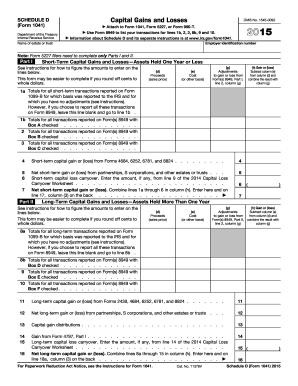

Filling out the IRS 1041 - Schedule D can seem daunting, but with clear guidance, the process can be straightforward and manageable. This form is essential for reporting capital gains and losses, and this guide aims to simplify that experience for users at all levels of experience.

Follow the steps to effectively complete the IRS 1041 - Schedule D online.

- Press the ‘Get Form’ button to access the IRS 1041 - Schedule D form and open it in your preferred editor.

- Identify and fill in the employer identification number and name of the estate or trust at the top of the form.

- Proceed to Part I for short-term capital gains and losses. Enter the proceeds, adjustments, cost, and calculate the gain or loss in column (h) based on the provided financial figures.

- Report totals for short-term transactions on lines 1a, 1b, 2, and 3 as necessary.

- Complete Part II for long-term capital gains and losses using the same procedure as part I, entering figures into the appropriate fields and calculating gains or losses.

- In Part III, summarize your short and long-term gains or losses to determine the overall performance.

- If applicable, move to Part IV to determine any capital loss limitations and ensure accurate reporting.

- Finally, review all entries made, make any necessary adjustments, and proceed to save changes or download, print, or share the completed form.

Complete your IRS documents efficiently online and ensure accurate reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

To access Schedule D on TurboTax, navigate to the 'Federal Taxes' tab and then choose 'Wages & Income.' From there, look for the section related to investments, where you’ll find the option to enter information for the IRS 1041 - Schedule D. TurboTax simplifies this process by directing you easily through the necessary steps.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.