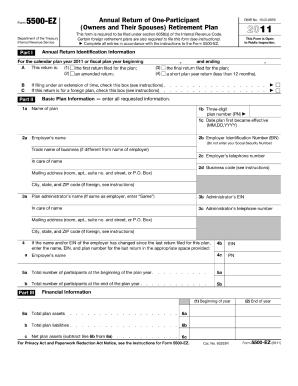

Get Irs 5500-ez 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 5500-EZ online

How to fill out and sign IRS 5500-EZ online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If individuals aren't linked with document control and legal operations, completing IRS forms appears burdensome. We completely understand the importance of accurately finalizing paperwork.

Our online tool provides the ideal answer to streamline the procedure of submitting IRS documents to be as straightforward as possible.

Utilizing our service will turn expert completion of IRS 5500-EZ into a reality. Make everything comfortable and easy for your work.

- Click the button Get Form to access it and commence editing.

- Complete all necessary fields in the chosen document using our helpful PDF editor. Activate the Wizard Tool to make the process even simpler.

- Verify the accuracy of the entered information.

- Add the date of finishing IRS 5500-EZ. Use the Sign Tool to create your unique signature for document authorization.

- Finalize editing by clicking on Done.

- Send this document directly to the IRS in the most convenient way for you: via email, with digital fax, or postal service.

- You can print it on paper if a physical copy is necessary and download or save it to your preferred cloud storage.

How to modify Get IRS 5500-EZ 2011: personalize forms online

Complete and authorize your Get IRS 5500-EZ 2011 swiftly and accurately. Access and alter, and sign adjustable form templates in the ease of a single tab.

Your document management can be significantly more productive if everything needed for altering and overseeing the process is organized in one location. If you are looking for a Get IRS 5500-EZ 2011 form template, this is a hub to acquire it and complete it without seeking third-party services. With this clever search engine and editing tool, you won’t have to look any further.

Simply enter the title of the Get IRS 5500-EZ 2011 or any other form and discover the correct template. If the sample appears fitting, you can begin altering it right away by clicking Get form. No need to print or even download it. Hover and click on the interactive fillable fields to enter your details and sign the form in a single editor.

Utilize more editing tools to personalize your form: Check interactive boxes in forms by clicking on them. Inspect other sections of the Get IRS 5500-EZ 2011 form text with the assistance of the Cross, Check, and Circle tools.

When provided with a smart forms directory and a robust document editing solution, handling paperwork becomes simpler. Locate the form you need, complete it instantly, and sign it on-site without downloading it. Simplify your paperwork routine with a solution crafted for editing forms.

- If you need to add more text to the document, use the Text tool or insert fillable fields with the appropriate button. You can also define the content of each fillable field.

- Insert images into forms with the Image button. Upload images from your device or capture them with your computer camera.

- Include customized graphic elements in the document. Use Draw, Line, and Arrow tools to sketch on the form.

- Annotate over the text in the document if you wish to conceal it or emphasize it. Cover text sections utilizing the Erase and Highlight, or Blackout tools.

- Add custom components such as Initials or Date using the respective tools. They will be generated automatically.

- Store the form on your device or change its format to the preferred one.

Get form

Employers with retirement plans must file the IRS form 5500. This includes plan administrators managing various employee benefits. Each entity is responsible for ensuring timely and accurate submissions to meet legal standards. Utilizing platforms like uslegalforms can simplify the filing process, helping you stay on top of your responsibilities.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.